TABLE OF CONTENTS

Before providing payment processing services to a business, a financial institution may request an up-front reserve. While there are several different types of reserves, up-front reserves are most often requested from businesses associated with elevated financial exposure. To mitigate this fiscal exposure, reserves are put in place to protect acquiring banks (or processing banks) from monetary setbacks. However, reserves also protect the business itself from monetary setbacks too! Read on to find out how up-front reserves protect your business, exactly how they work, and the reasons you might receive one after opening a merchant account.

What Is an Up-Front Reserve?

Reserve accounts are where inaccessible business funds are held to cover chargebacks, refunds, or other forms of financial liability associated with payment processing. What differentiates one type of reserve from another is the way in which the funds for the account are collected. In the case of up-front reserves, also known as pre-funded reserves, the funds are collected upon opening the merchant account or by holding 100% of the transaction funds until the reserve balance is met.

What is an average pre-funded reserve amount?

The average amount held in pre-funded reserves varies depending on each merchant’s approved processing volume. Typically, it is 50-100% of the merchant’s allotted processing volume per month. For example, if you were approved for $100,000 per month, your up-front reserve balance may be anywhere from $50,000 to $100,000.

How Do Up-Front Reserves Work?

Up-front reserves work by collecting a sum of money and putting it into a separate bank account to pay for any future losses, should your merchant account be terminated. It’s important to note that while reserves act as financial buffers for processing banks, these funds are still your hard-earned money. If there are no losses associated with your account, the full amount will be given back to you over time.

Additionally, these types of reserves can also be used to increase your approved processing volume. For example, you’re approved for $100,000, but you want to bump it up to $150,000 after a few months of healthy payment processing. In this case, your monthly processing amount may be increased after you funded the extra $50,000 in your reserve.

How is the reserve taken out of my account?

With pre-funded reserves, the funds can be collected immediately or incrementally. Most often, merchants are required to submit a predetermined dollar amount (based on their approved monthly volume) directly to the processing bank.

The less common method is one in which merchants can start processing, but all transaction funds are withheld until the reserve balance is met. In this case, if your approved volume is $100,000, you can start processing but your transaction funds will go into the reserve account until it reaches $100,000. Once the balance is fulfilled, the reserve will stop and transaction funds will be sent to your bank account. Though, this type of up-front reserve is most commonly requested of new businesses without an established processing history.

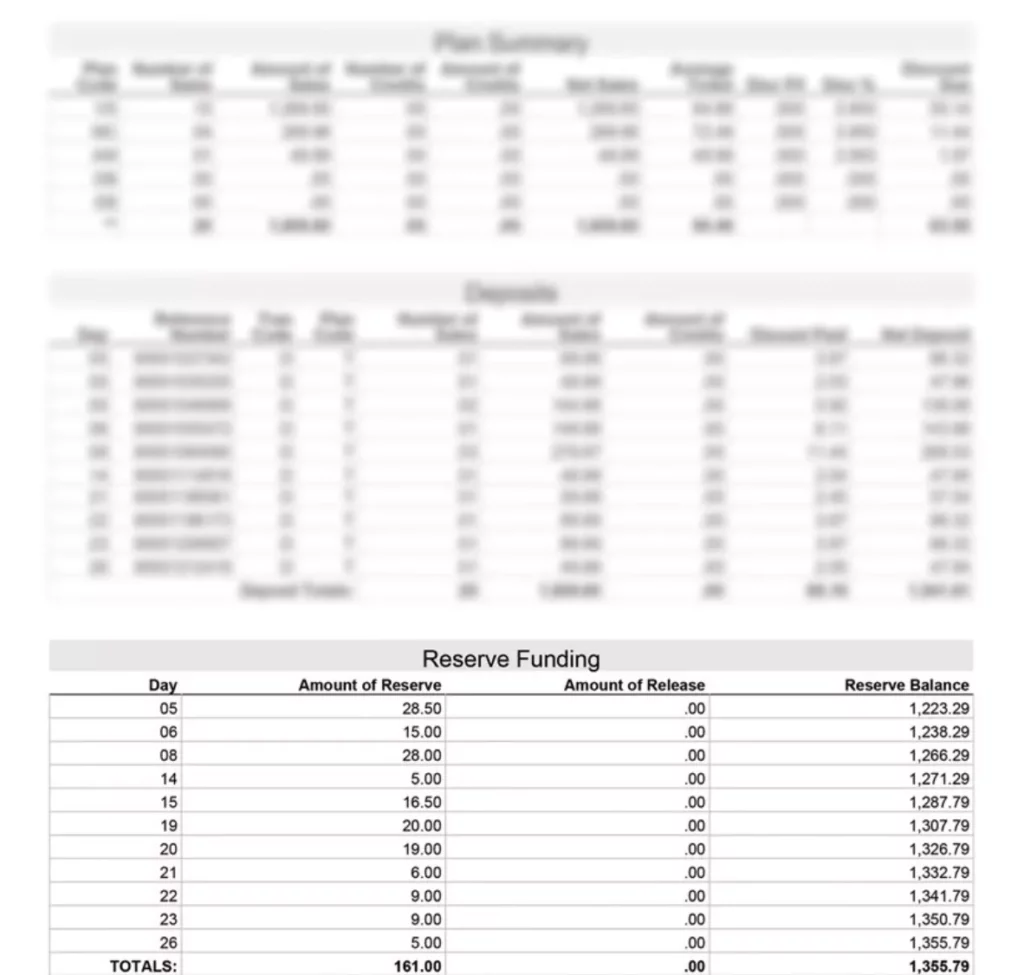

Where do the reserve funds stay?

Reserve funds are held by the payment processor in a non-interest-bearing bank account. Because this escrow account is tied to your merchant account, you can check its balance on your merchant statement at any time. See below for an example of where the reserve balance is located on a processing statement:

Up-Front vs Rolling vs Capped Reserves

Because they’re only requested of high-risk businesses associated with elevated financial exposure, up-front reserves are the most uncommon reserve type. While capped reserves and rolling reserves take a more lenient approach by allowing the reserve funds to accrue over time, up-front reserves require funding before anything else. However, the benefit an up-front reserve offers is its short-term timeframe. And once the reserve is met, you can start receiving 100% of your transaction funds.

What industries typically see a pre-funded reserve?

Industries with future delivery services are the most likely to see pre-funded reserve requests. Some examples include industries selling concert tickets, airline travel, or bottle service. As these types of services usually have delivery dates of six months or more into the future, buyers are known to change their plans. And since chargebacks can occur for up to six months post-delivery, the timeframe for customers to file chargebacks on these big-ticket transactions essentially doubles.

Why Do I Have an Up-Front Reserve?

As previously mentioned, up-front reserves aren’t as common as other types of reserves. If you’ve received an up-front reserve request, there are a few reasons why it happened. You may have been approved for a considerably large monthly processing volume, have a history of excessive chargebacks, or operate in an industry with increased liability.

It’s important to remember that processing banks implement reserves to ensure protection against financial liability. But reserves do not only protect banks! Reserves also protect your business from economic losses, even if it may not feel like it at the time.

How Do I Get my Up-Front Reserve Money Back?

An incremental reserve release can be negotiated after establishing a healthy processing history. If your processing history has proven to be trustworthy, the bank may agree to release the money back to you in stages. For example, they might initially release 20% of the reserve and continue to do so each month until it’s empty.

If you’re considering requesting a reserve release, it may be beneficial to ask your account manager to speak to your processor on your behalf, as they have experience negotiating releases.

What happens to the reserve money if I cancel my account or get shut down?

If your account is terminated, the reserve funds will be used to cover any financial liabilities incurred by your business—chargebacks, refunds, etc. After 180 days, at the end of the chargeback liability period, the remainder will be returned back to you. However, you can also check in with your processor every couple of months to see if they would be willing to release the funds back to you more quickly.

Note: Specific terms regarding reserve releases should be available in your monthly merchant statement.

Up-Front Reserves: Closing Thoughts

However frustrating they may be, up-front reserves are an easy way to gain trust from your processing bank. By providing significant funds up-front, you’ll establish a relationship with the processing bank and demonstrate financial responsibility. Additionally, reserves protect your business from financial losses—setting your business up for success! And speaking of setting yourself up for success, an experienced high-risk payment processing provider can help you negotiate the terms of your reserve to maximize its benefits to your business.

High-Risk Businesses Wanted

We’ll help you navigate reserves with no reservations!

Approval

Rating