TABLE OF CONTENTS

Merchant statements can be overwhelming. This article includes a guide that identifies the various aspects of a merchant statement, such as identifying information, price models, discount methods, processing fees, and chargebacks.

Continue reading to learn how to understand your merchant processing statement and why it’s essential to review it regularly.

What is a Merchant Statement?

Merchant or payment processing is a crucial aspect of modern commerce, enabling businesses to accept customer electronic payments. It involves the secure transmission of payment information between the customer’s financial institution and the merchant’s bank to authorize and complete transactions.

A merchant statement is a document that merchants receive every month detailing customer transactions and fees charged.

The merchant account statement typically includes a deposit summary with a breakdown of each party’s fees. Details about any fee the processor charged are usually detailed here.

At first glance, a merchant services statement may seem difficult to read. However, understanding the pricing model and discount methods can help you determine the best processing rates for your business.

Why it’s Important to Read and Understand Your Merchant Services Statement

Reviewing and understanding your merchant statement is crucial and a great way to monitor your business’s growth.

Your merchant statement details your monthly transactions and sales activity, including chargebacks to your merchant account. It also includes details of the credit card processing fees your business is being charged.

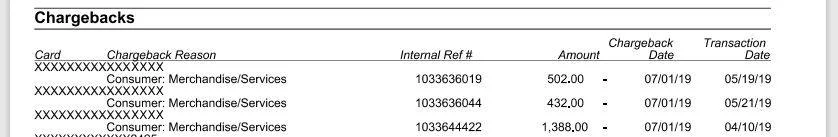

Identifying chargebacks

A chargeback occurs when a customer requests that their credit card provider return a charge to their account. The customer may initiate a chargeback because they did not purchase the product or service, it was purchased without their knowledge, they were unhappy with the product/service, or they never received it.

Chargebacks may also occur because of a stolen credit card or identity theft. Eight out of ten merchants have reported an increase in “friendly fraud” during the COVID-19 pandemic. Friendly fraud is a type of chargeback that occurs when the individual who reported the charge as unauthorized had knowledge, somehow benefited, or was complicit with the transaction.

Below is an example of how chargebacks are detailed on your merchant statement. You will see the last four digits of the card initiating the chargeback, along with the reason code, amount charged, chargeback date, and transaction date.

Understanding credit card processing fees

Your payment processor charges you for each card transaction your business runs. Regularly reviewing these credit card processing fees is vital as they typically change twice a year.

These fee changes are usually small but can add up if you don’t monitor them. There are two main cost components that you can use to separate and analyze your merchant processing statement:

- Wholesale or Base Cost – These are interchange fees. Interchange fees are charged by card brand companies like Visa and Mastercard to process each transaction. They vary depending on the card brand company and are fixed amounts that cannot be negotiated.

- Markup – A markup is an additional charge imposed by a payment processor or merchant service provider on top of the interchange fees and other processing costs. This markup fee is how service providers make their profit. It can encompass various costs, including transaction fees, statement fees, monthly minimum fees, and other charges.

Your payment processor may include the percentages charged for these components on your merchant statement. This makes it easy to see how much you’re paying in fees each month. If you aren’t able to calculate your fees or your statement doesn’t include this information, be sure to contact your processor and ask for this information.

How to Read a Merchant Statement

Reviewing your merchant processing statement is a balance of looking at the big picture and the details. If you think you’re paying too much or have questionable charges, you might need to check every fee on your statement to identify and confirm its source.

On the other hand, you don’t need to get that detailed with the individual fees and rates if you’re tracking overall costs to ensure your monthly amounts are reasonable and consistent. Now, let’s get into the five steps of reading your credit card merchant statement.

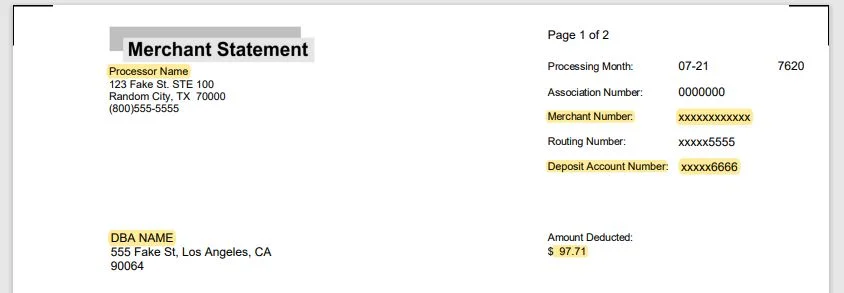

Step 1: Identify important information

When reading your merchant processing statement, the first thing to do is review the document to identify the critical information. These statements will look different from processor to processor, so you’ll want to understand the structure of your credit card merchant statement and see where the important information is found.

At the top right of your statement, you will find your processor’s name and contact information. Your business name and information are below. On the left, you’ll see the processing month, your Merchant Identification Number (MID), the deposit amount number, and the dollar amount deducted from this billing statement.

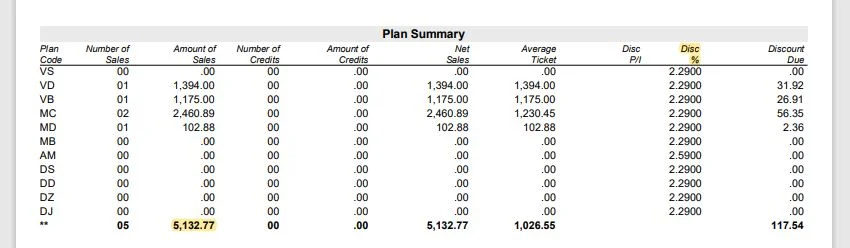

Below this, you will find your plan summary. This section itemizes the number of sales you’ve processed for each card brand and the interchange fee (discount percentage and discount due) associated with each transaction. In this statement, the discount rate is 2.29% for Visa Card (VS) transactions and 2.59% for American Express (AM) transactions.

The total amount of sales reflects the gross sales volume for your account.

Step 2: Determine which pricing model is used

The type of pricing model you have depends on your merchant processor. The most common include membership, flat-rate, interchange-plus, and tiered:

- Membership or subscription – This is a newer model where the markup is charged as a monthly subscription fee. There is also a separate small per-transaction fee, which is favorable for larger transactions.

- Flat-rate – All transactions will cost the same, including the wholesale cost. This typically results in high transaction costs, particularly with debit transactions.

- Interchange-plus – The wholesale and markup fees are all laid out, which makes it the most straightforward pricing model to understand, though it may take longer to review a merchant services statement.

- Tiered – This pricing model categorizes all your transactions into qualified, mid-qualified, and non-qualified. You receive the lowest rates on your qualified transaction and the highest for your non-qualified.

A tiered pricing model is demonstrated under “Plan Code” in the example below.

Step 3: Establish the discount method

A processor will use a daily or monthly discount to subtract fees from your account. The discount method that’s used affects the total fees your account is accessed, and it is something that you determine. Monthly discounting tends to be a better fit for most businesses, but here is a description of both:

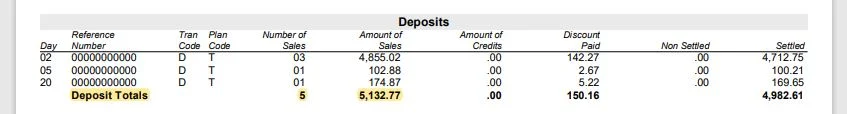

- Daily discount – the term “less discount paid” is typically used to identify this method. The processor will charge its qualified rate before settlement, transaction fees, and other charges at the end of the month. The daily discount report will have the fees paid throughout the month and those charged at the end of the month to calculate the total expenses.

- Monthly discount – Each fee is charged in one lump sum at the end of the month. This method is much easier to track on a statement.

Step 4: Calculate your processing fees

Now, you’re ready to identify your processing fees. You can take your total fees charged and subtract that amount from your interchange costs, which are your wholesale/base costs. What’s left is the markup that your credit card processor charges.

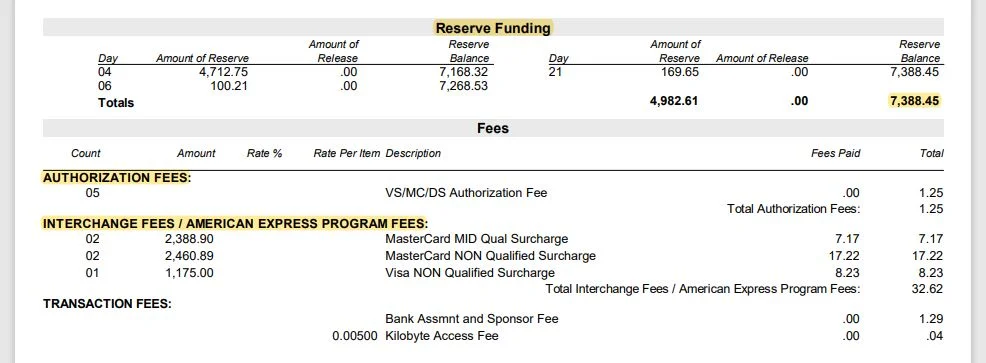

The below section of the merchant statement details the amount in the merchant’s rolling reserve account. The proceeding section lists the authorization and interchange fees – the percentage processors charge to process each transaction.

Step 5: Analyze the costs and compare with other processors

Keep track of what you pay in processing fees and review your rates annually. With zero to minimal chargebacks, you may be able to renegotiate your rates.

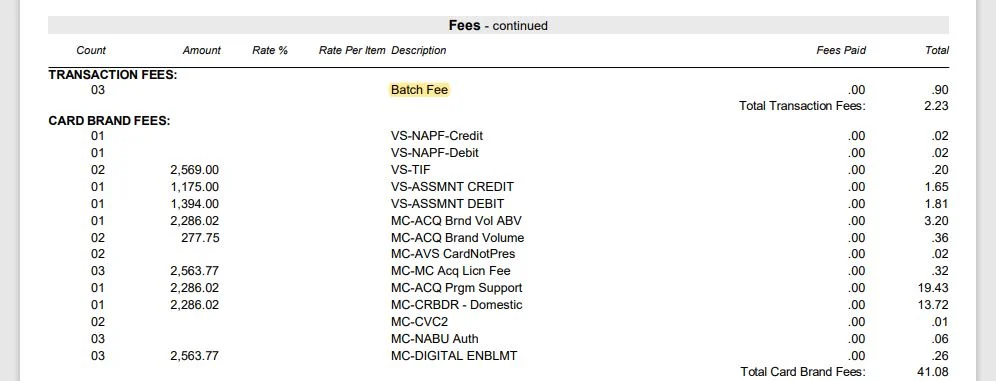

Below, we can see how processing fees differ per card brand and tier level.

Also pictured below is the “batch fee.” A batch refers to the total dollar value of transactions charged in a business day that will be transferred into the merchant’s business checking account. The batch fee is the processing fee for this transfer.

Final Thoughts

You now have the guidelines to easily tackle your monthly merchant processing statement. Once you’ve gotten used to reading your statements over several months, you’ll be able to quickly analyze them. Effective merchant processing requires careful attention to detail, proactive monitoring of transactional data, and strategic decision-making to optimize payment processing efficiency and minimize costs. By leveraging the insights gained from analyzing merchant processing statements and adopting appropriate payment processing solutions, you can enhance your financial performance and deliver a seamless payment experience to your customers.