TABLE OF CONTENTS

If you manage a high-risk business in today’s market, capped reserves are important to understand. While often viewed in a negative light, reserves can actually be a blessing in disguise. By setting aside a percentage of your current sales for future losses, your reserve protects you and your payment processor from potential losses. When issues arise and money is owed, your reserve then provides an added layer of security to the bank’s credit department, as well as your bottom line. In fact, you can think of a reserve as a savings account for yourself, and a safety blanket for the processing bank.

In this article, we’ll examine the importance of capped reserves, how they work, and why they are beneficial to your business—let’s get started!

What Is a Capped Reserve?

A capped reserve (also known as an accrual reserve) is a type of merchant account reserve that limits the amount of money held in it to an agreed-upon percentage of your credit card sales. This limit, or “capped” amount, is why it’s called a capped reserve. Once the capped amount is reached, the reserve will no longer withhold funds, with all future transaction funds sent to the merchant’s bank account.

The reason for capped reserves is to pay off debt associated with chargebacks, fraud, or other financial liabilities should the account be terminated. Since cardholders have an average of up to six months to dispute a charge, processing banks must ensure those transaction funds can be paid in the event of a dispute. Additionally, a capped reserve may be used to pay balances from ACH returns should the merchant’s bank account bounce.

What is an average capped reserve amount?

The average capped reserve amount varies depending on the size of the business. Generally, it’s half of your monthly processing limit. For example, if you’re granted $50,000 in processing volume per month, your reserve cap might be $25,000.

It’s also worth mentioning that reserve amounts are assessed on a case-by-case basis, depending on the risk profile of each merchant. The average amount taken out until the reserve is met is usually 10% of your credit card sales.

How Do Accrual Reserves Work?

Accrual reserves work by setting a limit on the amount of money that can be taken out of your merchant account at one time. Until the reserve cap is met, a percentage of your sales is withdrawn and put into a non-interest-bearing bank account in case there are any debts you cannot cover. If your merchant account is closed for any reason, these funds will be used to pay back your debts so the bank doesn’t have to cover them out of pocket.

How is the reserve taken out of my account?

The reserve is taken out of each transaction as a percentage of your total sales. For instance, if the reserve is 10% with a $25,000 cap, 10% of each transaction would be withheld in the reserve until the account balance hits $25,000. After hitting this balance, your transaction funds are transferred to your bank account untouched.

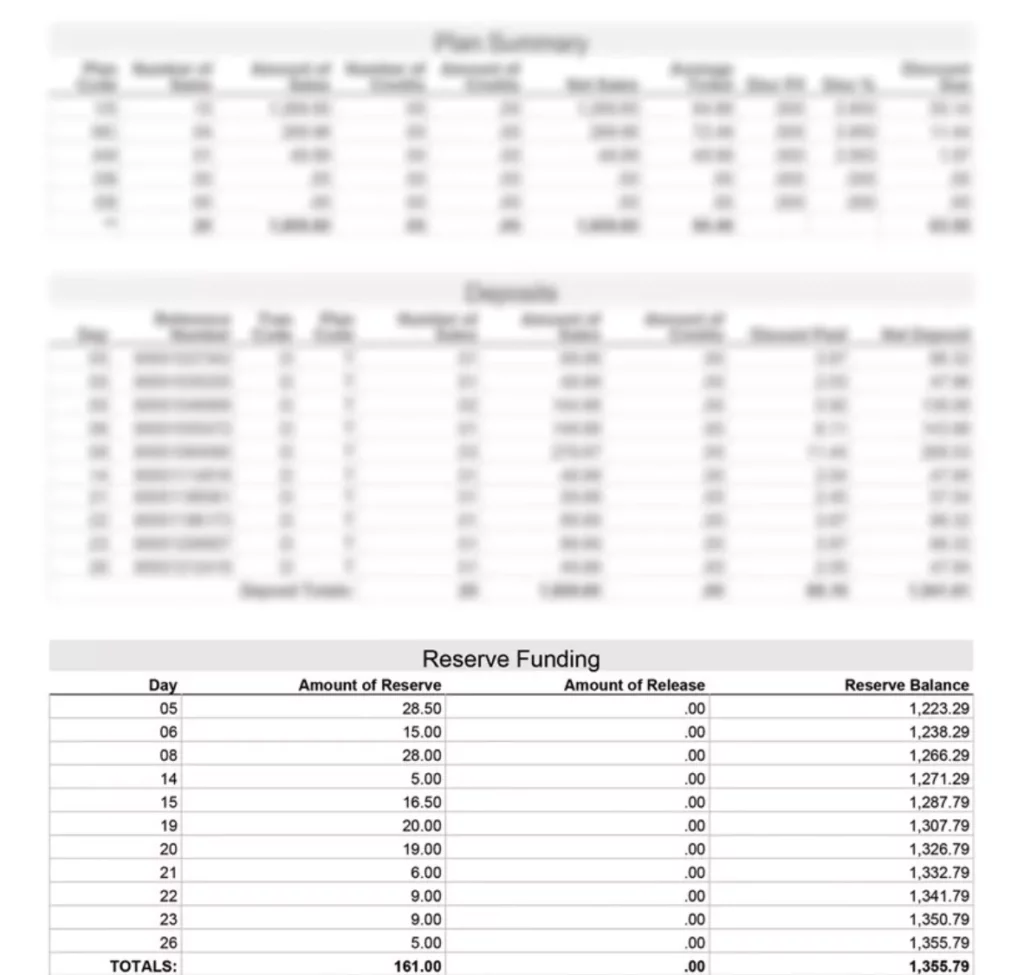

Where do the reserve funds stay?

The reserve funds stay in a separate account with the processing bank. However, this account is listed on your merchant account statement, so you can check your reserve balance at any time. See below for an example of a reserve balance on a merchant statement:

What happens once I hit my reserve cap?

Once the total agreed-upon capped amount is reached, the processor will no longer take a percentage of your sales during the duration of your merchant agreement. The reserve funds sit in your account until it’s closed, at which point, if you have good processing history, the bank will remit these funds to you.

In the event that you’ve already hit your cap but your processing volume limit is increased, your reserve cap will likely be adjusted relative to your new processing volume. For example, if your approved volume increases from $50,000 to $100,000, your reserve cap may increase from $25,000 to $50,000. In this case, you’re responsible for funding your reserve until it meets its new capped amount.

Capped vs Rolling vs Upfront Reserves

There are three different types of reserve funds—capped (or accrued), upfront, and rolling reserves. As explained above, accrual reserves are typically used for less risk-prone types of business, as they are satisfied after reaching the “capped” amount. Rolling reserves, however, are funded with a percentage of your total sales for each month, usually for a total timeframe of about six months.

Finally, upfront reserves are exactly what they sound like. Typically requested of the riskiest business types with larger volume amounts or increased exposure, upfront reserves require an initial chunk of money from the merchant to ensure there are existing funds if anything goes wrong.

Why are capped reserves the best option?

Capped or accrued reserves are the most favored type of reserve because it represents the least amount of risk. Unlike a rolling reserve, capped reserves don’t go into perpetuity, which allows merchants to see a light at the end of the tunnel. They are also more favorable than upfront reserves because you’re not initially dishing out a large chunk of money you might otherwise need.

Why Do I Have a Capped Reserve?

As previously mentioned, capped reserves are required for businesses carrying some high-risk factors. If an accrued reserve is requested, it usually means there were some elements of your operations that the risk department remained unsatisfied with during underwriting. In order to approve your account and mitigate its potential risks, they’ve decided to implement an accrued reserve. The good news is that the risk department didn’t see many threats associated with your business, which is why they opted for a capped reserve instead of a rolling or up-front reserve.

What industries typically see a capped reserve?

High-risk businesses that see reserves are usually those with higher than average chargeback liability—either due to their industry SIC code or future delivery components. However, reserve types aren’t always industry-specific, so it’s hard to say which industry merits which reserve type.

A few industries that commonly require capped reserves include travel (as events can be canceled due to weather or airline issues), contractors (due to the possibility of changes in work orders or unanticipated expenses), and transportation services (accounting for liabilities that arise from transporting goods). As you can see, there are various operational elements that can result in a reserve being requested. Some other common sectors that warrant reserves include the adult, CBD, gambling, and pharmaceutical industries.

How Do I Get My Capped Reserve Money Back?

Once you reach your reserve cap, a release can be rewarded at the processor’s discretion. To negotiate a reserve release, reach out to your account manager and request they speak to the processing bank about returning your funds. Most reputable banks have experience negotiating reserve releases and will do so if you’ve proven to be trustworthy. Depending on your processing history, refund rate, and chargeback ratio, the bank will determine whether they feel comfortable releasing the money back to you.

Be aware that reserve releases are usually executed in stages. For example, the bank might initially release 20% of the reserve and continue doing so every three months until it’s returned.

How long do I have to wait to get my reserve money back?

As all processing banks are different, this depends on the specific details outlined in your merchant agreement. In the event that your merchant account is terminated with a reserve balance, you’ll generally have to wait about six months (or 180 days) to receive the balance. Since reserves are intended to protect processing banks from potential losses on your account, they need to make sure that they have sufficient funds to cover any issues that may arise following account closure.

What happens to the reserve money if I cancel my account or get shut down?

If you cancel your merchant account, your processor may hold your reserve funds for 180 days to cover losses during the chargeback liability period. However, you can check in with the processor every 60 days to see if they would be willing to release them more quickly.

If your account gets shut down, there was probably an issue with fraud or chargebacks, which means the bank will use the reserve funds to pay back those debts. After 180 days, the remainder will be returned to you. That said, it’s always wise to read the fine print in your merchant statement so you know this information before signing a contract.

Accrual Reserves: Closing Remarks

Amongst high-risk businesses, reserves are a normal part of credit card processing. While it can be frustrating that these withheld funds are inaccessible—thus cannot be immediately reinvested into the business—reserves can effectively help to mitigate the costs associated with unforeseen losses, which in turn helps to keep your business safe. That said, reserves don’t last forever. It’s important to communicate with your account manager to renegotiate the terms of your reserve or negotiate a reserve release. And by partnering merchant services provider with high-risk payment processing expertise, you’ll be paired with an account manager experienced in navigating reserves for maximum merchant benefit!

PaymentCloud—putting the fun in your funds!

Satisfaction