To build a good business credit score, the SBSS score is what business owners should look to. This score shows lenders how capable you are of repaying a loan and determines your interest rates. In this article, we’ll be looking at what the FICO SBSS score means, how it works, and most importantly, tips on how to improve it.

What Is the FICO Small Business Scoring Service (SBSS)?

FICO’s goal is to help companies establish better credit scores. More specifically, FICO offers analytics software and tools to companies around the world to control risk, battle fraud, build customer relationships, and comply with government regulations. FICO SBSS, which stands for “small business scoring service,” focuses on small business financing. Through its scoring system, it assesses small business owners on their ability to pay back a loan.

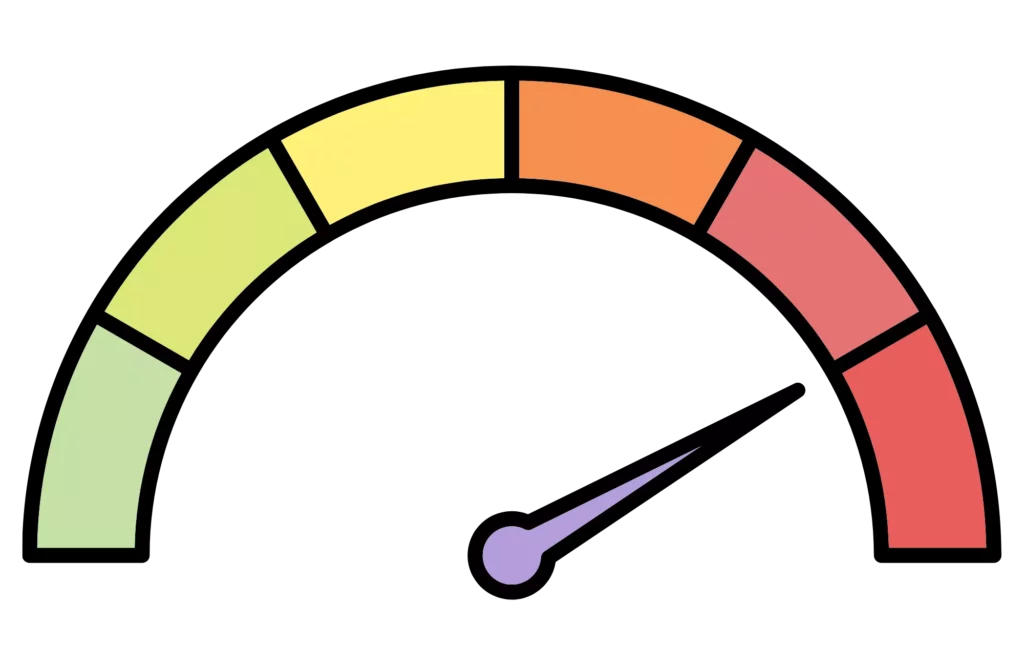

The FICO SBSS score is one of the many credit scores that lenders use to assess companies. When you request a loan, a lender will search your DUNS number and look at your business credit score. The score can be between 0 to 300, with 300 being the best possible score. The SBA, or Small Business Administration, requires all businesses applying for a loan to have a score of at least 140.

How Is Your FICO SBSS Score Calculated?

The SBSS evaluates your small business score with the help of two main things:

- Personal finance: This includes factors such as on-time payment history, types of loan accounts, and your credit utilization rate.

- Business finance: This includes factors like the number of employees, cash flow, time in business, and major complaints and lawsuits against your company.

If your company is relatively new, then it’ll probably have no business credit score history. If that’s the case, your overall score will solely depend on your personal FICO credit score.

What Is a Good FICO SBSS score?

What’s a good FICO SBSS score may depend on what your end goal is. For the average business, you’ll want to have a score above 140 to be able to apply for small business loans from the SBA. For other institutions such as banks or credit unions, this number can go as high as 180. This means that anything above 180 will make your business a trustworthy borrower no matter the lender. However, if your goal is to have an outstanding SBSS score then you will want to aim above 200.

Why Does Your FICO Business Credit Score Matter?

FICO scores are critical for businesses because they determine your creditworthiness and your ability to get low-interest loans. Additionally, it is based on hundreds of consumer and business analysis models and draws information from a variety of sources. Therefore, it’s able to prescreen loans efficiently while automatically excluding applicants that don’t meet the minimum requirements.

How to Check Your SBSS Score

While you can easily check your personal FICO score on its website, your SBA credit score is not the only condition for receiving a loan. Each lender has its own assessment tools and may take your personal loan into consideration. At the end of the day, it’s a completely subjective assessment tool and each lender will approve you based on their criteria.

Tips to Improve Your FICO SBSS Score

It can be challenging to boost your FICO SBSS, no matter what your entrepreneurial background is or how poor your credit score is. Fortunately, you can take charge of your FICO SBSS credit score with these tips below:

Pay your bills on time

You can demonstrate to lenders that you’re a responsible borrower by paying your accounts in full and on time each month. Also, it doesn’t hurt to call your creditor if you are 30 days or more late on a payment. If you can make up the late payment, ask the creditor to reconsider reporting to credit bureaus.

Build your business credit

Building your business credit isn’t very difficult. All you have to do is establish your business by receiving a DUNS and EIN number, opening a bank account and keeping track of your business credit.

Maintain good personal credit

To maintain good personal credit you’ll have to pay your loans on time, stay within a healthy range of your credit limit, apply for loan accounts you need, and monitor your credit score.

Reduce the amount of business credit you use

The amount of business credit you use is also called credit utilization which can be either high or low. It’s high if you use too much of the credit that has been awarded to you. If it’s low then you’re not using enough of the amount of credit you are allowed to use. This can be calculated through your credit utilization ratio (CUR):

CUR = Credit Balance / Credit Limit

Experts suggest you keep this ratio to 30% or below.

Utilize accounting best practices

Best practices for accounting include creating a straightforward financial plan, utilizing accounting software, and tracking expenses. Implementing healthy financial habits may seem like a lot of work but will make a difference to your bottom line in the long run.

SBSS Credit Score: Final Thoughts

SBSS score is an important credit score assessment tool lenders use when prescreening applicants. Keep this score as high as possible because it allows you to be considered a creditworthy business. However, if you’re a business owner with a low credit score, you are not out of options. There are plenty of companies that offer business loans for bad credit and can find the best funding solution for you. If you’re not quite ready for a business loan, there are still alternative business lending options available.

FICO SBSS Score FAQs

Are there consequences to having a low FICO SBSS credit score?

Like with any other credit score, if your FICO SBSS score is low, you’re less likely to get a loan and work with partners. Luckily, you can always improve it by following our tips.

What credit bureau does SBA use?

The SBA uses the FICO SBSS to determine whether businesses are worth lending to. Using more than 100 combinations of consumer and business analytics models, the program streamlines the loan approval process.

What is the minimum FICO score for an SBA loan?

The average FICO score for getting an SBA loan is somewhere over 140 — the higher, the better. Any business scoring below 140 may find it hard to be approved for a loan.