An EIN lookup is necessary for more occasions than one might think. Just as every citizen in the U.S. has a social security number to identify them, a business has a unique identifier too. An Employer Identification Number (EIN) is required for many businesses and for some business types, required by law. If you need to conduct an EIN lookup or just want to better understand what it entails, read on. We’ll cover everything you need to know for your business, including how to look up your EIN and common places to find it.

What is an EIN?

An EIN lookup will tell you that an EIN stands for Employer Identification Number. This term falls under the umbrella of the Taxpayer Identification Number (TIN). Additionally, EIN is also referred to as a “FEIN” or a “ax ID number” or a “Federal tax identification number.”

An EIN or any TIN is issued by the Internal Revenue Service. It is a 9 digit number issued to identify your business. The requirement of an EIN is not based on where you operate your company, but on how. Specifically, an EIN identifies a business and is used for tax purposes. However, just because you own a business, does not mean you must have an EIN. The law does not require certain business structures, such as sole proprietorships, to have one. If your business does not need an EIN, the business owner can use their social security number for tax purposes.

Although not always required, it is highly advisable to obtain an EIN, even when not legally required. This is because providing your social security number for all your business needs poses a higher risk of identity theft and fraud. Knowing the most prevalent signs of fraud is the best way to protect yourself and your business.

When is an Employer ID Number Required?

Before you start your business, you should know if you need an EIN in the first place. If you own a business that has any of the following, you’ll need to apply for an EIN:

- Any number of employees

- Certificate of Incorporation (or you’re taxed as an entity with one)

- A history of bankruptcy

- A multi-member LLC structure

- A 401k plan or Keogh plan

- Inherited or purchased a business

Ensure you identify the Responsible Party on an EIN Application, as they will be the main contact for the IRS.

If you are a required entity, it’s important to understand the financial planning and budgeting needed to ensure the longevity of your company. While applying for an EIN is free, additional corporate licenses and permits are not. Your accountant will review and analyze all these expenses for tax purposes.

Was I Given an EIN?

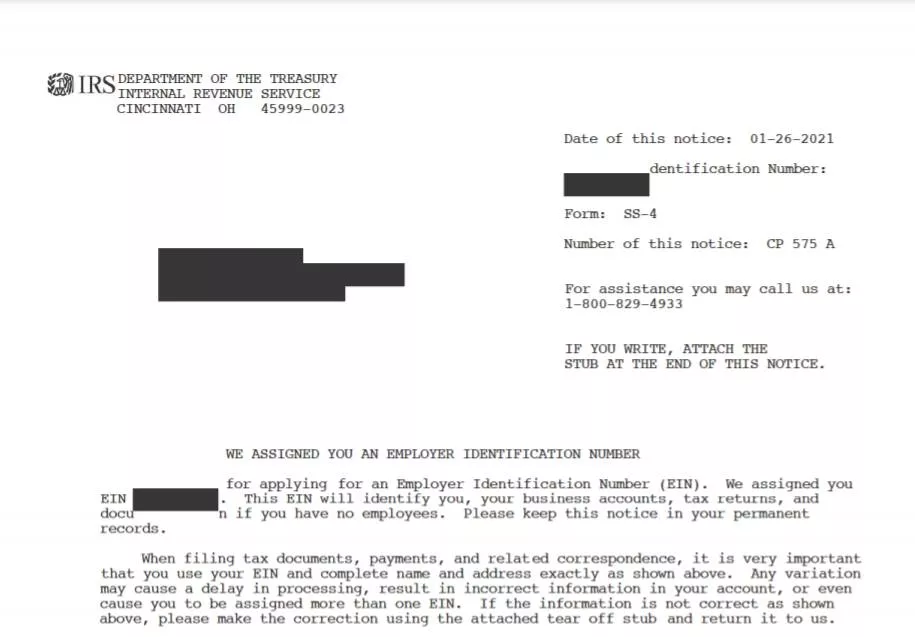

If you have not filed for an EIN, you will not have one. You must fill out an application with the IRS to have one issued to your business. This will include IRS form SS-4.

To apply for a tax ID number, the process is quite fast and simple. As long as you are located in the United States and have either an SSN, EIN, or ITIN already, then all you have to do is apply online. Follow the steps and you’ll be issued an new EIN in no time. But how long does it take to get an EIN? The IRS often processes online applications immediately, but mail or fax applications can take up to four weeks.

EIN vs TIN

When thinking about EIN vs TIN, it’s important to note that an EIN is not the same as a TIN (Taxpayer Identification Number). A TIN is an umbrella term that includes three types of numbers the Internal Revenue Service uses for tax purposes:

- Employer identification number (EIN): This number identifies a business.

- Social security number (SSN): This number identifies an individual.

- Individual Taxpayer Number (ITIN): This number identifies non-US citizens.

- DUNS Number: This unique identifier is issued by Dun & Bradstreet and is used to establish a business’s credit file, which can be helpful when applying for loans or government contracts.

As you can see, an EIN is a type of TIN. It’s up to you to know which TIN number you must use for your business’s taxes. Similarly, there are methods to look up the appropriate TIN for your business as well.

How to Find Your EIN: 7 Places to Look

If you have lost or misplaced your federal tax identification number, try one of the following options:

- Call the Business and Specialty tax line and have the IRS help you track it down. Their number is 800-829-4933

- If you applied for a state or local license, ask the licensing agency to look it up for you

- Did you open up a bank account using your EIN? Contact the bank so they can assist you in finding your tax ID number

- Did you request a credit report for your business? The report should include your EIN

- After applying for your EIN, you should have received a computer-generated notice as a receipt. Try to track that down

- Find one of your previous tax returns that would have used the EIN. All tax returns will include this number

- Did you file for a business loan? Review those documents and find the EIN used

Review tax paperwork

As mentioned before, one of the fastest and easiest ways to recover your Employer Identification Number is by reviewing your business’s tax paperwork. This number appears on all of your tax documents. Your accountant is a great person to call in case you’ve misplaced your latest tax documents or need an EIN lookup.

Contact the IRS

You can contact the Business and Specialty tax line by dialing 800-829-4933. Their office is open from Monday through Friday between the hours of 7 AM and 7 PM EST. After placing your call, a representative will ask you a few questions to verify your identity and to ensure you are authorized to receive the EIN. All of this is for the safety and protection of business owners.

EIN Lookup: Other Businesses

If you would like to look up the EIN of an entity you do not own, there are a couple of options to choose from:

- First, are they registered with the U.S. Securities and Exchange Commission? If so, simply visit the EDGAR System section of the SEC website and search by company name, ticker symbol, CIK number, or the owner’s first and last name.

If the company is not registered with the SEC you’ll need to use a little elbow grease. In that case, you can do one of the following:

- Hire a third party company to find this information for you

- Contact the business’ finance department or accountant and ask them for their EIN

- You may want to buy the business’s credit report

- Try looking up their local or federal registration forms online

Nevertheless, it’s important whether you need this number to validate a business’s information or for your work, you take the steps to ensure anything out of place is discovered sooner rather than later. EIN lookups are possible for entities you do not own as they are open for public viewing.

Can I Cancel an EIN?

The IRS cannot cancel an EIN. Once this number is issued, it’s permanently used to identify the entity.

If you must close your business, the IRS can only close your business account. All you need to do is send a letter to the IRS with the business address, your EIN, and the name of the legal entity indicating why you need to close your business account. Additionally, if you can enclose a copy of the EIN Assignment Notice you received when the number was first issued, even better!

Use an EIN Lookup to get Your EIN Today

As a business owner, it is important to arm yourself with the education and resources you need to stay out of financial or legal trouble. Whether you’re missing your EIN and want to conduct an EIN lookup or are curious about this number before registering, we hope you found some of the answers to your questions. After obtaining your business’s EIN, you can begin processing payments and reaping the rewards of your hard work.