TABLE OF CONTENTS

If you’re a merchant who deals with credit card processing, it’s hard to know what type of card someone has without understanding the bank identification number. The problem is, it can be difficult to identify a BIN from just looking at a card. That’s why we created this guide that includes everything you need to know about BINs and how they work. This article will teach you how to find out your own BIN using a BIN checker, as well as how merchants can use them for security purposes.

What is a Banking ID Number (BIN)?

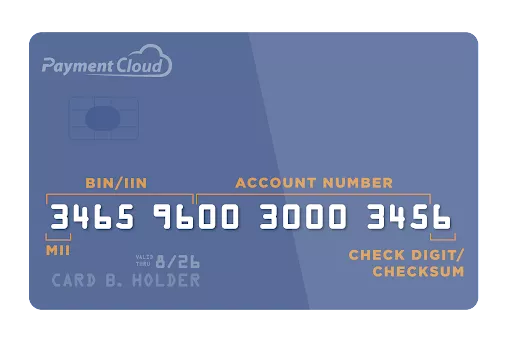

A Bank Identification Number (BIN) is the first six digits of a credit card number that will identify the issuing bank, card brand, card type, card level, and country of a credit card. Merchant point-of-sale systems use this information to verify whether payments are being sent from an authentic account and to also identify which type of card you have. In other words, it’s how credit cards are identified in the payments industry.

How Do BINs Work?

Each card issuer has its own BIN. The first four digits signify the institution that issued the card, while the remaining digits identify a specific card type within that issuer. If you have an American Express credit card, the associated number begins with 34 or 37 and is followed by four numbers in any order (it can’t contain more than 10 digits). An example of this would be 346596 / 491653 / 520402. The same holds true for Mastercard – it usually starts with a number between 51 and 55 and has a maximum of 12 digits.

Bin Examples

Here are a few examples and common formats used by the major card brands.

Information from the card with the BIN number 4833 16 translates to:

- Card issuer: JP Morgan Chase

- Card brand: Visa

- Card type: debit card

- Card level: classic

Information from the card with the BIN number 4400 66 translates to:

- Card issuer: Bank of America

- Card brand: Visa

- Card type: credit card

- Card level: classic

Issuer Identification Number Ranges (IIN)

- Visa: 4*****

- Mastercard: 51**** through 55****

- Discover: 6011, 622126-622925, 644-649, 65

- American Express: 34**** or 37****

The Major Industry Identifier (MII)

You may have seen this acronym come up in your bin search. The first digit of a credit card number is known as the major industry identifier or MII, and it has its own meaning. The MII identifies the type of the issuing institution. American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) developed a numbering system to identify institutions that issue payment cards. Financial payment cards, such as those branded with Visa and MasterCard logos are mostly issued by banks and so fall into the category of payment networks.

List of MII Types

| MII Digit Value | Issuer Category |

| 0 | ISO/TC 68 and other industry assignments |

| 1 | Airlines |

| 2 | Airlines, financial and other future industry agreements |

| 3 | Travel and entertainment |

| 4 | Banking and financial |

| 5 | Banking and financial |

| 6 | Merchandising and banking/financial |

| 7 | Petroleum and other future industry assignments |

| 8 | Healthcare, telecommunications, and other future industry assignments |

| 9 | For assignment by national standards bodies |

What are BIN Numbers Used For?

BIN codes help merchants and other parties involved in the payment ecosystem to identify the card issuer. If you swipe your credit card at a shop or website, they can use bin checker tools to verify it’s genuine. They also identify what type of card is being used, so both sides are clear about which security features are valid for that transaction.

Why are BIN Numbers Necessary?

Bin numbers are important as they provide merchants and processors with all the information needed to assess both the risk and interchange fees of the transaction. The BIN number tells a merchant:

- If the issuer is in the same geographic location as where the transaction takes place

- If the address provided by the cardholder is the same as what’s listed on file

- The issuing bank’s contact information

- The type of card brand (Mastercard, Discover, American Express, Visa, etc.)

- The card type (debit, credit, prepaid, standard issued bank card, rewards card, etc.)

- The card level (type of rewards program)

What is BIN Scamming?

BIN scamming or BIN attacks are a form of credit card fraud that involves stealing identities or illegally obtaining credit cards directly from banks or merchants. In this type of crime, criminals try to pose as a bank in an attempt to purchase goods and services with stolen credit cards. To do so, they use their own BIN numbers on pre-made fake cards.

What is BIN cloning?

Bin cloning is one of the most common types of credit card fraud in use today. It involves the illegal duplication, resale, or misuse of payment cards, including magnetic stripe cards and chip-based cards. This usually occurs when an individual’s personal information is stolen by criminals to create clones or fake cards.

How can you protect your business from BIN scamming or cloning?

The automated BIN lookup process is useful as it allows merchants to cross-reference credit card details and make sure they match other data points surrounding the transaction (i.e., location of issuer bank vs customer shipping address). This helps mitigate risk of credit card fraud and catch suspicious activities. There are many anti-fraud tools that include automated BIN lookups at the transaction level and integrate with shopping carts/gateways.

- DISCLAIMER: Do not rely solely on BIN lookup data as it does not provide you with enough information to define if a transaction is valid. Supplement your data set with information about the cardholder based on details like IP address, email address, phone number, device fingerprinting, etc.

Final Thoughts

In this article, we’ve defined what BIN numbers are and how they are relevant in the payment landscape. We’ve covered proper misuses of BIN codes and how it may affect your business, as well as how to protect yourself from BIN code scamming or cloning. BIN numbers are important to know for both merchants and cardholders because they provide a wealth of information about the type of credit card being used, where it was issued from, if it’s valid, etc. For merchants who accept payments (whether online or in-store) this is essential data that helps them make informed decisions to protect themselves from falling victim to credit card fraud.