TABLE OF CONTENTS

Within the payments industry, VAR sheets are of extreme importance. These documents carry all of the information regarding your merchant account and communicate said information to your payment gateway. So, without VAR sheets, payment gateways cannot function properly.

In this article, we’ll explain what a VAR sheet is, why it is imperative to your business, and how to obtain one.

What Is a VAR Sheet?

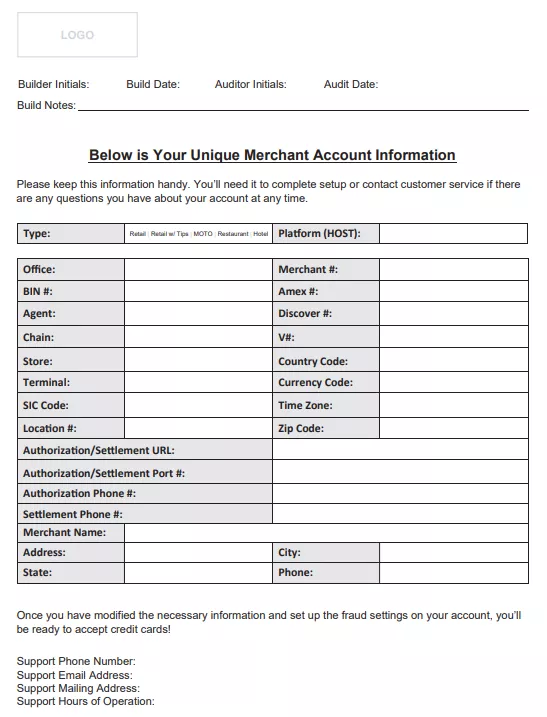

VAR sheets, also called parameter sheets, are documents establishing a connection between your merchant account and your payment gateway. These sheets carry detailed information about your business, your processor, and your merchant account. You can think of them as a prerequisite, as you must provide them with your gateway to accept payments. Here’s what they typically include:

- Merchant ID number (MID)

- Merchant category code (MCC)

- Merchant account information

- Merchant account platform information

- Processor data

- Business Information

What does “VAR” stand for?

VAR stands for value-added reseller. Basically, VAR sheets allow companies to add value to third-party products by tailoring them to their businesses.

When Do Merchants Use VAR Sheets?

To accept payments online or over-the-phone payments, merchants must implement payment gateways. In order to integrate a payment gateway, the gateway company will need access to the information on your VAR sheet. During this process, your merchant account is connected to your gateway ID on the backend so the two can communicate.

Since VAR sheets are used to transmit and verify critical information, they are mostly used by businesses operating virtually—though sometimes by brick-and-mortar stores too. For example, if a merchant has their own terminal, separate from their processor, a terminal sheet (or VAR sheet) is necessary to reprogram their device with the correct data.

On the other hand, if the merchant accepts in-person payments but doesn’t have their own equipment, no VAR sheet is needed. The terminal provided by the processor would already have the VAR information programmed on it.

For online businesses with multiple websites or products, VAR sheet requirements can also increase depending on the integrations required.

VAR sheets and high-risk businesses

If your business is considered high-risk, it’s helpful to use a third-party payment processor, not a payment aggregator. Payment aggregators do not usually utilize VAR sheets. This can lead to strict transaction limitations and frozen funds.

Additionally, when partnering with a third-party payment processor, your data can easily be accessed and transferred. This is especially useful in the event that you should require another merchant account.

When is a VAR sheet not needed?

As mentioned, VAR sheets aren’t needed for typical merchant accounts under one circumstance: businesses operating in physical locations using the equipment provided by their payment service provider. In this case, the information is already programmed into the device.

VAR Sheet Example

VAR sheets are all different. Their outline and format depend on the bank from which you receive them, but their content is consistently the same. Below, you’ll find an example of a standard VAR sheet:

How to Get a VAR Sheet

Typically, you’ll receive a VAR sheet from your processing bank after you set up a merchant account. For additional help regarding the acquisition of a VAR sheet, you can always contact your merchant services provider.

Can You Accept Payments Without a VAR Sheet?

Yes, you can accept payments without a VAR sheet, but only with payment aggregators. However, aggregators aren’t recommended for high-risk business types, as they frequently impose pre-decided transaction limits and are known to hold funds.

Managing VAR Sheets for Online and In-Person Transactions

VAR sheets are equally necessary for online and in-person transactions because they hold the inaformation that enables you to accept credit card payments.

When credit card readers make payments, the physical terminals hold the VAR sheet files. If you’re using a merchant account in conjunction with a payment gateway, the necessary information is on the VAR sheet you received from your processing bank. To start accepting payments, you’ll need to provide the VAR sheet to your payment gateway, and they will connect it to your merchant account.

Final Thoughts on VAR Sheets

VAR sheets are documents containing vital information about your merchant account and are necessary for your payment gateway to properly function. Finding a trusted partner with extensive payment gateway solutions that utilizes VAR sheets can significantly enhance the security and simplicity of your business’s credit card processing operations—especially if you operate in a high-risk industry!