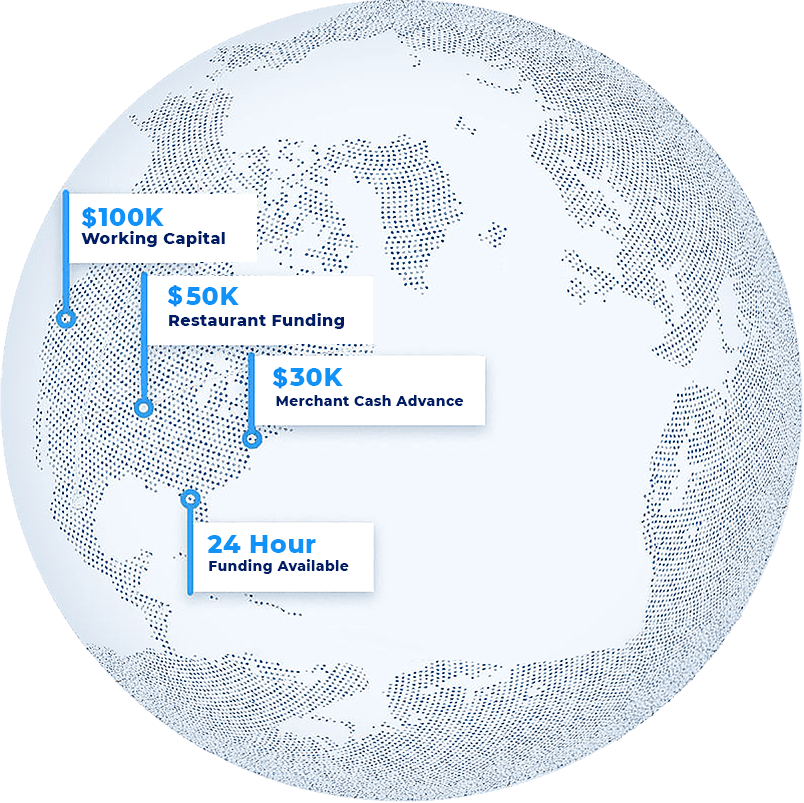

Merchant Cash Advance with Same-Day Funding

- Quick Approval

- Minimal Paperwork

- No Collateral

- Transparent Structure

- Manageable Repayment

- Multi-Loan Approval

I was able to get my cash advance within 24 hours. This allowed me to continue operating my business when I needed cashflow the most.

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is a form of financing through which you use your current sales volume to obtain money from a lender. Unlike traditional loans with defined term lengths, MCA financing gives you access to a lump sum of funds from a capital provider on an as-needed basis. This type of financing allows you to borrow money against your future receivables—ideal for small businesses that use credit card processing!

200,000 +

Fundings Completed

1,000 +

Long-term Business Relationships

1.5 billion +

Financing Secured

24 hrs

Funding Available

Jump to a Section

Should Your Business Consider a Merchant Cash Advance?

If you need hassle-free business funding in a flash, a merchant cash advance is your answer! Thanks to the easy application, repayment structure, and established connection with your merchant services provider, an MCA is a great tool that helps new and existing businesses flourish.

However, they may not be the best choice for every business. If you deal mostly in cash, need immediate funding, want your revenue flow to remain uninterrupted, or prefer an exact end date for your agreement, you may need to look into other small business loan alternatives. Short-term loans, invoice factoring, and installment loans may be better for your personal needs and business practices.

Which Industries Are Ideal for Business Cash Advance Loans?

A merchant cash advance loan is best suited for businesses with high volumes of debit or credit card transactions, as repayment is based on a percentage of daily card transactions. Additionally, a cash advance benefits businesses that don’t typically qualify for traditional loans. The below business types will likely benefit from MCA funding.

High-Risk Businesses

Due to increased financial exposure, lenders often deny “high-risk” business owners more traditional financing options. Fortunately, high-risk merchants remain excellent candidates for a merchant cash advance! Businesses operating in the below industries are typically considered high-risk businesses:

- Adult

- Bail Bonds

- CBD

- Firearms

- Tobacco

Additionally, businesses with high sales volumes may also fall into the high-risk category due to their increased risks of chargebacks and fraud. Because a cash advance for business is granted based on sales volume, these businesses are particularly well suited for this form of financing.

Restaurants

Running a restaurant can be unpredictable. As such, there may be times when you can’t meet daily expenses and need access to funding with little notice. A merchant cash advance can immediately provide the influx of cash required for any unexpected costs.

Online

Online businesses often find it difficult to secure funding from traditional loans due to a lack of physical assets that can be used as collateral. With a merchant cash advance, online shops can simply use their credit and debit sales to pay back the loan without ever providing collateral.

Get the cash you need without the long and complicated application process

Apply now for a merchant cash advance and receive funds as soon as tomorrow.

How Much Does a Merchant Cash Advance Cost?

Compared to traditional loans, merchant cash advances offer more flexibility, leniency, and speed, but these advantages come at a cost.

Note : Typical factor rates for merchant cash advances range from 1.1 - 1.5

While the exact price you’ll pay varies by lender, a merchant cash advance fee is typically the “factor rate” multiplied by the “buy rate.” You may also be subject to processing and closing fees.

When you partner with PaymentCloud, you don’t have to worry about overpaying for your merchant cash advance. Your dedicated account manager will meticulously assess financing options to ensure you secure the best rate available!

What's Required to Get an MCA?

While business loan requirements may be slightly more difficult to meet, requirements to get a MCA are much more lenient. To apply for a merchant cash advance, you only need to fill out a simple application and provide 3-6 months of business bank statements. (Personal bank statements are not accepted. Sole proprietors must provide business bank statements.)

Upon approval, you must provide a valid driver's license, voided company check, and Proof of Ownership (Articles of Incorporation or IRS Form SS-4).

For advances $75k - $150k, provide the above information plus:

- Tax returns

For advances over $150k, provide the above information plus:

- Current year financial statements

- Current balance sheet

How to Apply for a Merchant Cash Advance

- Complete the application with your business information.

- Gather the required documents listed above.

- A dedicated account representative will contact you to complete the application.

- Sign and submit the application, along with the required documentation.

- Receive approval and funding in as little as 24 hours.

Why Choose PaymentCloud Partners for Your Business Funding Needs?

When it comes to finding financial solutions for your business, it's important to partner with a reliable provider. We understand that a loan is not one size fits all. Our trusted partners will work closely with you to tailor a funding plan meeting your specific goals. With a team of financial experts at your disposal, you’ll be back to running your business smoothly.

If you’re looking for a provider that connects you with the best financing for your unique business needs, a PaymentCloud partner is the right choice!

Merchant Cash Advance FAQs

What is the difference between a loan and a cash advance?

A “cash advance” may sound similar to a traditional business loan, but there are fundamental differences between the two. Unlike a loan, a merchant cash advance purchases future receivables. Repayment can be in the form of split payments or recurring ACH withdrawals. Additionally, MCAs do not require a specific credit score for approval and do not request collateral. On the other hand, a traditional loan has fixed monthly payments, more stringent qualifications, and often requires collateral.

Additionally, the government heavily regulates the business loan space, while merchant cash advances operate outside this sphere. Some states are implementing regulations on these types of sales agreements. However, as a borrower, you should not expect the same protections as you would with a traditional loan.

Can a startup get a business cash advance?

In short, yes. A startup can get a business cash advance. As long as you have been in business for at least 6 months and are consistently processing at least $10,000 per month in sales, you meet the minimum qualifications.

Who is eligible to apply for a merchant cash advance?

Any business owner who is a United States citizen and operates their business in the U.S. is eligible. You must be in business for a minimum of six months and gross at least $10,000 per month in sales. All business entity types are eligible.

Can you get a merchant cash advance with bad credit?

Yes, you can get a merchant cash advance with bad credit as long as other evaluation factors are strong. Credit score isn’t the defining factor for approval. In fact, this is what makes MCAs appealing. The eligibility requirements are much less stringent than that of traditional business loans from a bank or local credit union.

What are the benefits of a merchant cash advance?

A major benefit of a merchant cash advance is the speed at which you receive funding because they are typically approved within 24 hours, as opposed to traditional banks which could easily take over a month. Additionally, cash advances require minimal paperwork and often no collateral.

Another significant benefit is the repayment process. These payments come directly from your profits. For example, in instances where your lender sets up split funding with your merchant account, holdbacks are deducted at the transaction level. The MCA repayment process, in conjunction with a fixed factor rate, makes cash flow projection simple because you always know the entirety of what you owe.

What happens if you don't pay back a merchant cash advance?

Generally, merchant cash advance lenders are willing to offer flexibility in their repayment plans. These lenders may be willing to negotiate more affordable payments by lowering the rate, extending the repayment term, or, if necessary, offering a forbearance period.

If you default on your merchant cash advance, the lender may attempt to recoup their funds by going after your bank account and even seizing additional assets.

Note : To avoid this unfortunate situation, communicate financial difficulties with your lender.

Can I get a merchant cash advance with no credit check?

Without a credit check, a lender will not have an understanding of the borrower’s financial reliability. While there may be lenders that offer merchant cash advances without a credit check, this can lead to higher interest rates and excessive fees—ultimately doing more harm than good to your business.

Ready to Get Funded?

Connect with our capital partners on merchant cash advance options & receive a quick quote in a matter of minutes.