TABLE OF CONTENTS

- What Is a Routing Number?

- What Is an Account Number?

- What Is a Check Number?

- Where Are the Routing, Account, and Check Numbers on a Check?

- Routing vs Account Number Example

- Why Are Routing Numbers and Account Numbers Important?

- When You May Need to Provide Your Routing and Account Number

- Routing and Account Numbers on a Check: Closing Thoughts

In order to process an electronic funds transfer (EFT), you need to specify your account number and routing number. Your account number is like your account’s identification number, whereas the routing number identifies the bank at which your account is located. Read on to find out what these numbers are, how to locate them, and why they’re important.

What Is a Routing Number?

A routing number, known more formally as an ABA Routing Number or Routing Transit Number, identifies a financial institution within the United States. This unique string of nine digits is issued to federal or state-chartered financial institutions with a Federal Reserve account. First used to efficiently process paper checks, routing numbers have maintained their importance in the digital age due to their vital role in electronic funds transfers.

In most cases, banks only have a single routing number used within the United States. However, if the bank conducts operations in several locations, it may have more than one routing number. Because Chase, for example, has locations in most states, it has state-specific routing numbers. Thus, the routing number for a Chase account opened in Idaho differs from the routing number for a Chase account opened in Michigan.

Below is a list of the most popular banks and where to locate their routing numbers.

What Is an Account Number?

While the routing number identifies the financial institution, the account number identifies the specific account at the institution. Typically comprised of 8-12 digits, your account number informs the bank where to deposit or withdraw transaction funds.

Every account you open is issued a unique account number. However, the routing number may be the same if your new account is at the same bank.

What Is a Check Number?

A check number is your tracking mechanism for each check you write. The shortest of the bunch, check numbers typically consist of 3-4 digits. Unlike routing and account numbers, check numbers don’t contribute much to the process of transferring funds electronically.

Where Are the Routing, Account, and Check Numbers on a Check?

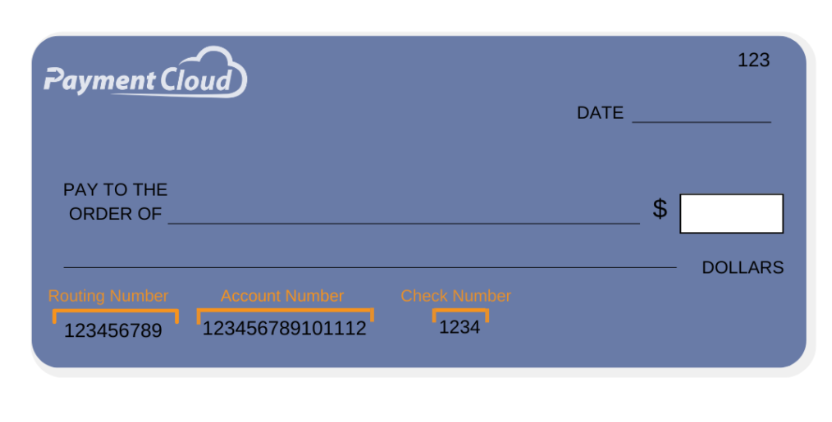

At the bottom left corner of a check, you can find the routing, account, and check numbers. The first, leftmost digits are the routing number (usually consisting of nine digits), the second set of digits are the account number (usually consisting of 8-12 digits), and on the furthest right side is the check number (usually consisting of 3-4 digits). However, please note, this order may differ depending on the bank.

How to find routing and account numbers if you don’t have a check

You can also find your routing and account numbers online. In order to do so, access your online banking platform through a web browser or a mobile app. On the main dashboard, you should be able to view your account and routing numbers under the account details. If you are unable to locate your bank’s routing number, you may also find this number on the homepage of your bank’s website or through a search engine, as this is public information. However, ensure you’re searching for the bank’s routing number in the correct state.

If you are unable to locate your bank’s routing number online, you may need to visit your bank in person or give them a phone call. They should be able to assist you with finding your account information. The bank may require you to disclose certain personal information in order to authenticate you as the account owner. This can include your social security number or driver’s license.

Routing vs Account Number Example

Magnetic ink, known as the Magnetic Ink Character Recognition (MICR) line, is used to identify and process checks. Thanks to this technology, each bank’s equipment can quickly read and process the routing and account numbers for any transaction. This technology also helps eliminate check fraud by verifying that the check was produced through a secure check reader.

Below is an image detailing each of the three numbers on the MICR line of a check.

Why Are Routing Numbers and Account Numbers Important?

Be it a transaction initiated electronically or with a paper check, your routing number and account number play a key role in ensuring the money is deposited to or withdrawn from the correct account. Without routing and account numbers, banks wouldn’t have the ability to process the number of daily transactions they currently do, as these numbers easily designate where funds are to be deposited and/or withdrawn.

Additionally, your routing and account numbers are critically sensitive information that can be used against you. For this reason, make sure you keep your information secure and regularly check your accounts for fraudulent transactions.

When You May Need to Provide Your Routing and Account Number

First and foremost, every EFT requires your routing and account numbers in order to process successfully. The following list contains the next most common scenarios in which you will require your routing and account numbers:

- Setting up direct deposit with an employer

- Receiving a tax refund or stimulus check through direct deposit

- Buying products or services online via eCheck

- Receiving government benefits through direct deposit

- Paying your bills online

- Scheduling an ACH payment or sending/receiving wire transfers

- Setting up mobile banking

- Linking your account(s) to a budgeting app

- Sending money to or receiving money from friends and family

Routing and Account Numbers on a Check: Closing Thoughts

Let’s review our key takeaways:

- A routing number is a nine-digit number used to identify financial institutions within the United States.

- An account number is an 8-12-digit number used to identify the specific account at the institution.

- You can locate your routing and account numbers on the bottom left corner of a check. If you don’t have a check, you can visit your bank’s website or mobile app to determine your account and routing numbers.

Now that you know what routing numbers and account numbers are, why they’re important, and where to locate the numbers associated with your specific bank account, you’re ready to process eChecks, ACH payments, and other forms of electronic funds transfers.