Every state has its own version of credit surcharge laws, which makes compliance challenging. To avoid fines and penalties, you need to understand these laws and how they interact with brand-specific regulations from networks like Visa and MasterCard. It’s a complex landscape that can be difficult to navigate on your own. This guide helps with a comprehensive breakdown of credit card surcharge laws by state. Read on to discover what rules your business needs to follow, tips for maintaining compliance, and answers to frequently asked questions about credit card surcharge laws.

Key Takeaways

- Card brand-specific regulations set a maximum credit card surcharge fee of 3% for Visa and 4% for MasterCard or the merchant’s cost of card acceptance, whichever is lower.

- Some states have set lower maximum fees. In most states, the cost you pass on to the customer can’t exceed your cost of accepting the credit card transaction.

- To remain compliant with credit card surcharge laws, you must follow strict disclosure rules. Violating any of these surcharging laws can result in hefty fines and penalties.

Quick Recap: What Is Credit Card Surcharging?

Merchant account fees can cut into your profits, especially if you operate in a high-risk industry where processing rates tend to be even higher. To help offset these expenses, many merchants choose to add a small fee to credit card transactions — a strategy known as credit card surcharging. This allows businesses to pass a portion of the processing cost on to customers who opt to pay with credit rather than absorbing the full expense themselves.

However, there are strict credit card surcharge regulations and card network rules that govern how and when you can apply such a charge. It’s essential to understand and follow these guidelines carefully to remain compliant and avoid potential fines or penalties.

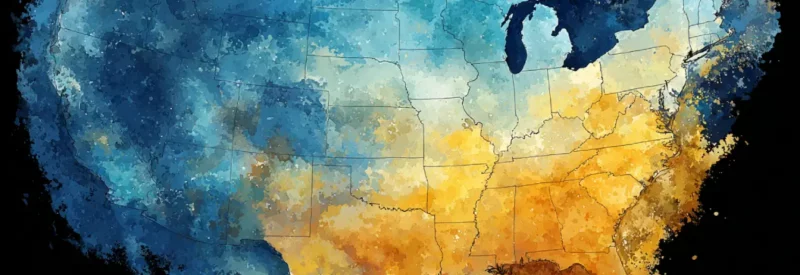

At-a-Glance: 2025 Credit Card Surcharge Laws by State

You’ll need to follow the credit card surcharge laws of each state where you sell products. Some allow surcharges up to the card brand limit, while others allow none. Some states have also set their own rules you’ll need to follow. Here’s what this means in practice.

Fully Allowed

These states allow credit card surcharge fees up to the card brand limit — 3% for Visa as per Visa’s surcharge rules and 4% for MasterCard or the cost of card acceptance, whichever is lower. If you do business in one of these states, you’ll need to disclose your surcharge fees before purchases and on receipts. You can typically meet your notice requirement with a sign at the register or a disclaimer on your website.

States in this category: Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

Allowed with State-Specific Limits

The following states have established their own credit card surcharge regulations.

- Colorado: Max surcharge of 2% or the cost of processing, whichever is lower.

- New York: The fee you charge must not exceed your cost of accepting the credit card. Flat-rate percentage mark-ups are not allowed unless they match your cost exactly.

- New Jersey: The fee must not exceed the actual processing cost.

- Nevada: No explicit cap, but state law gives enforcement power through consumer fraud statutes. This means you can be fined if your surcharge practices are misleading.

- South Dakota: The fee must not exceed the actual processing cost. Merchants who use excessive or undisclosed surcharges may be prosecuted.

- Minnesota: The maximum surcharge is 4%; merchants must disclose the total price a customer will pay, including these fees, upfront.

- Oklahoma: Card brand rules apply. A state law prohibited surcharge fees, but a federal court found the legislation to be unconstitutional. The state has not actively enforced the prohibition since, but the law technically remains on the books, creating ambiguity.

Most of these states limit your maximum surcharge to what you pay. So, if you pay 1% in credit card processing, that’s the maximum you can pass on to the consumer. If you pay 3%, you could charge up to that amount. You can potentially implement a surcharge system to achieve zero-cost credit card processing, but you cannot profit by issuing surcharges exceeding your processing costs.

State-by-State Breakdown of Credit Card Surcharge Laws

Here’s a closer look at the specific credit card surcharge laws by state (updated August 2025), along with other key restrictions where applicable.

| State | Status | Max Surcharge | Key Restrictions |

| AL[1]Alabama Department of Revenue. “Are Credit Card Transaction Fees Subject to Sales and Use Taxes?” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| AK[2]Alaska Department of Law Consumer Protection Unit. “Alaska Consumer Protection Laws.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| AZ [3]State of Arizona Senate. “Arizona House Bill 277 (2017).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| AR[4]Attorney General of Arkansas. “Convenience Fees, Service Fees, and Surcharge Fees.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| CA[5]State of California Department of Justice. “Credit Card Surcharges – Attorney General.” Accessed August 27, 2025. | Not Allowed | N/A | Surcharges prohibited; penalties for violations. |

| CO[6]Colorado General Assembly. “SB21-091 – Credit Transaction Charge Limitations.” Accessed August 27, 2025. | Allowed with Limits | 2% | Must disclose surcharge; cap enforced by statute. |

| CT[7]State of Connecticut, Department of Consumer Protection. “Surcharges.” Accessed August 27, 2025. | Not Allowed | N/A | Surcharges prohibited; penalties for violations. |

| DE[8]City of Newark, Delaware. “Credit Card Fee Discussion.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| FL[9]My Florida Legal. “How to Protect Yourself: Credit Card Surcharges.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| GA[10]Consumer Ed Georgia. “Credit Card Surcharges.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| HI[11]State of Hawaii. “Senate Bill 470 HD2.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| ID[12]The Official Website of Idaho Legislature. “Idaho Statute 31-3221.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| IL[13]Banking Journal. “Illinois Lawmakers Vote to Delay Implementation Date for State Interchange Fee Law.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| IN[14]Indiana State Government. “Office of the Indiana Attorney General, Consumer Protection Division.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| IA[15]Iowa Government. “Consumer Credit Code §537.2501 (2019).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| KS[16] Kansas Office of Revisor of Statutes. “Kansas Statutes Chapter 16a, Section 2-403.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| KY[17]Kentucky General Assembly. “House Bill 259 (2013).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| LA[18]Louisiana Government. “House Bill No. 487 (2024).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| MA[19]The 194th General Court of the Commonwealth of Massachusetts. “General Laws Chapter 140D, Section 28A.” Accessed August 27, 2025. | Not Allowed | N/A | Surcharges prohibited; penalties for violations. |

| ME[20]Maine Legislature. “1509-A. Payment by Credit Card.” Accessed August 27, 2025. | Not Allowed | N/A | Surcharges prohibited; penalties for violations. |

| MD[21]Maryland Government. “Credit Card Processors (Merchant Processing Agreements) – Financial Regulation.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| MI[22]Michigan Consumer Protection. “Credit and Debit Card Surcharges.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| MN[23]Minnesota Legislator, Office of the Revisor of Statutes. “325G.051 Surcharges on Credit Cards.” Accessed August 27, 2025. | Allowed with Limits | Not specified | Allowed for private entities; restricted for government. Surcharges must be built into advertised price. |

| MO[24]Missouri 102nd General Assembly. “House Bill No. 2383.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| MS[25]Mississippi Department of Finance and Administration. “Final Rule.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| MT[26]Montana Code Annotated 2023. “Payment of Fees and Taxes by Credit Card and Other Commercially Acceptable Means.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| NC[27]North Carolina Office of the State Controller. “Credit Card Convenience Fee and Surcharge Rules.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| ND[28]North Dakota Government. “State Credit Card Administration.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| NE[29]Nebraska Legislature. “Nebraska Revised Statute 81-118.01.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| NH[30]New Hampshire Banking Department. “Laws, Rules & Guidance.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| NJ[31]New Jersey Consumer Affairs. “Credit Card Surcharges Frequently Asked Questions.” Accessed August 27, 2025. | Allowed with Limits | Not specified, may not exceed than the actual cost to process the credit card payment. | Must disclose surcharge practices. |

| NM[32]New Mexico Government. “House Bill 545.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| NV[33]Nevada State Legislature. “BDR 52-1024.” Accessed August 27, 2025. | Allowed with Limits | Not specified | Must not exceed cost; must disclose surcharge practices. |

| NY[34]New York State Governor’s Office. “Governor Hochul Announces New Law to Clarify Disclosure of Credit Card Surcharges Goes Into Effect Sunday, February 11.” Accessed August 27, 2025. | Allowed with Limits | Not specified | Must disclose surcharge practices in advertised prices; enforced via court ruling. |

| OH[35]Ohio Laws & Administrative Rules. “Ohio Revised Code §113.40.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| OK[36]Oklahoma Legislature. “Senate Bill 677 (2025-2026).” Accessed August 27, 2025. | Allowed with Limits | Not specified | Must follow card brand rules; must disclose surcharge practices. |

| OR[37]Oregon Laws. “ORS 825.502: Payment of Taxes and Fees by Credit Card.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| PA[38]The Official Website of the Pennsylvania General Assembly. “Transparent Payment Fees Act.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| RI[39]State of Rhode Island. “Senate Bill 925 (2021).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| SC[40]South Carolina General Assembly. “House Bill 3477 (2013-2014).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| SD[41]South Dakota Consumer Protection Office of Attorney General. “Credit, Debit, and ATM Cards.” Accessed August 27, 2025. | Allowed with Limits | Not specified, may not exceed than the actual cost to process the credit card payment. | Must follow card brand rules; must disclose surcharge practices. |

| TN[42]Tennessee General Assembly. “Senate Bill 316 (109th GA).” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| TX[43]Texas Business and Commerce Code. “Code §604A.” Accessed August 27, 2025. | Not Allowed | N/A | Surcharges prohibited; penalties apply. However, state ban is currently unenforceable due to court ruling. |

| UT[44]Utah Division of Consumer Protection. “Surcharges and Fees.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| VA[45]Legislative Information System. “SB1212: Virginia Consumer Protection Act.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| VT[46]Vermont General Assembly. “Title 9: Commerce and Trade, Chapter 063: Consumer Protection.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| WA[47]Washington Department of Revenue. “Surcharges Including Tariffs.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| WI[48]Wisconsin Restaurant Association. “Credit Card Surcharge Questions?” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| WV[49]Cornell Law School. “W. Va. Code R. § 112-12-4 – Convenience Fees or Service Fees.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

| WY[50]Justia U.S. Law. “2024 Wyoming Statutes – Definition of Credit Service Charge.” Accessed August 27, 2025. | Fully Allowed | 4% (3% for Visa cards) | Must follow card brand rules; must disclose surcharge practices. |

Note: Credit card surcharge laws are subject to change. For the most up-to-date information, check the most recent state legislature on the subject.

How to Legally Implement a Credit Card Surcharge

You’ll need to review card brand rules and state regulations to implement a legal surcharge fee. In practice, that typically means doing the following:

- Notify Card Networks: Merchants must give 30 days of advanced warning to Visa, MasterCard, and other card networks before implementing a new surcharge fee.

- Cap the Fee: Review whether your state has a surcharge cap. If it does, follow that; if it doesn’t, comply with the card brand caps.

- Exclude Debit and Prepaid Cards: Surcharge fees are not allowed on these payments, even if they are processed as “credit” in your system.

- Post Clear Notices: Display clear signs explaining your surcharge policy at the point of entry and point of sale online and in person.

- List Surcharges on Receipts: Show the surcharge fee you charge as a separate line item to increase transparency.

Remember, credit card surcharge options can vary by card issuer. For example, even if your state lets you charge up to 4%, Visa caps its fees at 3%. This means your policy may need to differentiate between cards from different issuers. Additionally, keep in mind that American Express requires its cards to be surcharged at the same rate as other cards, and Discover prohibits surcharges that exceed the cost of payment processing.

Tips for Staying Compliant and Reducing Risks

Credit card surcharge regulations are complex and constantly evolving, which creates some risk for your business. You can manage these risks and stay compliant with the following strategies:

- Monitor Changing State Laws: Watch state legal resources to stay on top of regulations as they change. Subscribing to a newsletter or email list is an easy way to do this.

- Work with a Processor that Supports Compliance: The right payment processor can automate most of your compliance. These companies should automatically differentiate between credit and debit cards, apply surcharges only when legal, and deliver strategic support.

- Train Staff: Teach your employees to follow your surcharge rules, share mandated disclosures with customers, and resolve customer complaints about your policies.

- Consult Legal Counsel, if Necessary: If you run a complex, high-risk business or operate in multiple states, consider consulting with an attorney. They can review your practices and ensure they’re compliant everywhere you operate.

Choosing a Merchant Service That Supports Surcharging

Choosing the right payment partner is a crucial step toward achieving long-term surcharge compliance. Some providers offer no help, while others can streamline your efforts significantly with features like:

- Clear surcharge displays that appear as customers finalize purchases

- Strategy optimization support

- Detailed compliance resources

If you’re looking for a supportive partner that can help with credit card surcharge options, PaymentCloud has you covered. We offer custom merchant accounts that support surcharge compliance through tailored strategies. Get in touch to learn more about how our credit card processing solutions can help you stay compliant, save money, and grow.

Level up your business operations.

Accepting payments has never been easier.

Satisfaction

Credit Surcharge Laws by State: FAQs

Are credit card surcharges legal in the US?

Yes, surcharging is legal if merchants comply with requirements. However, some states have set rules, and others have banned surcharges entirely. This means your ability to use credit card surcharge fees depends on the states in which you operate.

Which states allow credit card surcharging with restrictions?

Colorado, New York, New Jersey, Nevada, South Dakota, Minnesota, and Oklahoma allow legal credit card surcharges with restrictions.

Which states prohibit credit card surcharging?

As of this publication, California, Connecticut, Massachusetts, and Maine prohibit credit card surcharges entirely.

Is a 2% charge on a credit card legal?

Yes, a 2% credit card surcharge is legal in most states. However, it may be illegal if you operate in a state that prohibits surcharges or one that caps your fee at a lower rate in line with your cost of processing.

How can I legally notify customers about credit card surcharges?

You can notify customers about surcharges with clear signage at the store entrance and point of checkout, both online and in person. You should also itemize the surcharge on the customer’s receipt. Some card brands may require specific language. Using templates from your payment partner can help you comply with these requirements.

What is the legal difference between surcharging and cash discounts?

Cash discounts are legal throughout the United States, while surcharging is only legal in certain states. See our blog post to learn more about the differences between cash discounts and surcharge programs.

Can I surcharge debit card transactions as well?

No, you can’t apply surcharge fees to debit or prepaid cards, even if they run as “credit” on your system. This practice is illegal in all 50 states.