TABLE OF CONTENTS

Understanding whether to hire 1099 or W2 workers is an important business decision. In the US, 1 in 5 employees is a contract worker. As a business owner, choosing between a 1099 vs W2 worker makes a difference in how your business accounts for their wages on your taxes, as well as the way the worker is taxed. Before hiring occurs, make this decision. Let’s talk about the difference between W2 vs 1099 employment and which type could be a better fit for your business.

The Difference Between Contract Workers and Employees

Contract workers are also known as independent contractors. They typically do work that your business needs to get done on a contract basis. For example, you run a property management business and want to hire a web developer to build a custom website. It would make sense to hire a contract worker to complete this work for you as a one-time gig.

This type of worker usually sets their own hours and may have their own resources to complete their work. It’s common for contract workers to work for more than one business at a time. From a tax perspective, there is typically no need to withhold taxes for a contract worker. This is because they are considered self-employed and must pay their own taxes.

Employees are hired under an employment agreement with your business. You have more control over employees for items such as work hours and responsibilities. Taxes from their wages must be withheld, and your business may also provide benefits such as health insurance and paid time off. Employees may undergo specific training once they have been hired. Additionally, your business must pay employment taxes when you have official employees. Let’s learn more about 1099 vs W2 employees and their advantages.

What is a 1099 Employee?

A 1099 worker is a self-employed contract worker. These contract workers are responsible for reporting their own employment taxes. Benefits such as health care and insurance aren’t provided by your business. 1099 employees are responsible for obtaining their own benefits.

In recent years, the workforce is more reliant on independent, 1099 employees. Research completed by Paychex indicates that there has been an 11 percent increase year over year until 2017 and outpaced growth for hiring employees by small businesses.

Advantages of 1099 employment

The growth in popularity of using 1099 vs W2 employees is due to the many advantages they offer. When your business needs a specialized job or project completed that doesn’t require ongoing work, contract workers are often the best choice. Advantages of 1099 employment include:

- More flexibility. Contract workers are hired to take on a specific task or project and complete it in a certain amount of time. Once the work has been accomplished, the contract has been fulfilled and the worker is released.

- Less expense to your business. There are no payroll taxes or benefits that must be provided to a contract worker. This can save your business money as opposed to having employees on staff.

- Specialized skills and expertise. The work that contract workers perform is often what they are already well-trained for. This means in most cases, there’s no training necessary.

What is a W2 Employee?

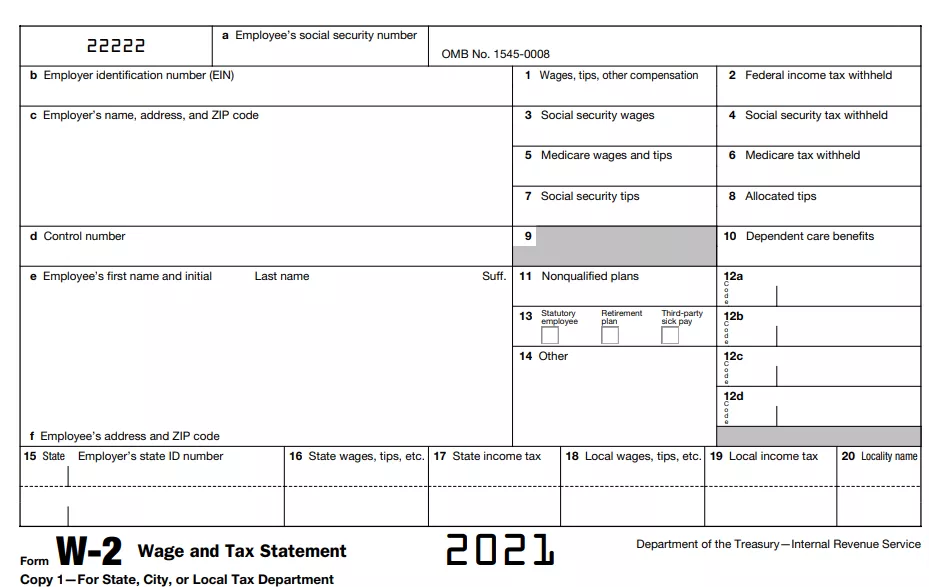

A W2 employee is one who works for your business, whose labor you control. In this case, your business is responsible for withholding payroll taxes on their behalf. The IRS expects you to report each of your employees’ salary and tax information. You will also provide a W2 to your employee each year, so they have a record of their earnings throughout the year and can submit them with their personal taxes.

Advantages of W2 employment

Your business may need to hire a W2 employee over a contract worker when the work that needs to be performed is ongoing. This is the more traditional route of hiring a staff member. The advantages of W2 employment include:

- More control. The schedule, work that’s performed, and operating process is all controlled by you. When your business goals require things to be done a certain way, hiring employees is the way to go.

- Employees tend to be more loyal. There is more financial security associated with a steady paycheck and a long-term relationship with an employer. This will typically make employees more loyal to your business.

- Your business has more support. During busier times, employees can be counted on to work more to get the job done. Additionally, they can host a multitude of responsibilities.

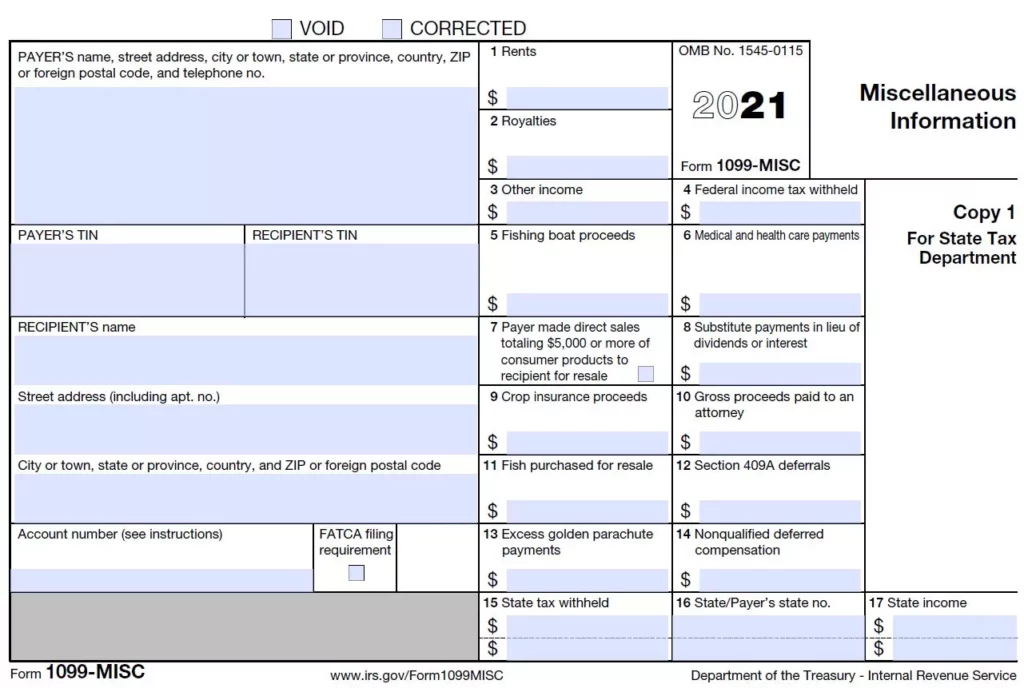

1099 vs W2 Forms

Whether you hire a contract worker or employee makes a difference in whether you use a W2 or 1099 tax form. Contract workers will use a 1099-MISC to report payments your business makes to them. Your business will use a W2 form for employees.

1099 vs W2 Taxes: How are they Different?

As you’ve learned, the way you offer employment will affect the way in which your employees will submit their taxes. It’s worthwhile to note how the actual taxation will take place for 1099 vs W2 employees. Let’s jump in!

1099 Employee Taxes

The major difference between 1099 and W2 status is classification. Generally speaking, any individual who is paid over $600 by your organization will need to receive a 1099 form. If you’re offering employment status at a contractor level, your employees will need to fill out a W-9 form. Similar to a W2, this submission accesses the employee’s TIN and certificate information.

Because your 1099 worker is considered a contractor, you do not need to provide benefits or tax their payments on pay day. Instead, you rely on the contract terms and conditions drawn up at the time of employment. Therefore, contracted workers are responsible for reporting the taxes they should be paying every paycheck. Some of these expenses include:

- Federal income tax

- Social security tax

- Medicare

- Federal unemployment taxes

While these expenses will vary depending on your state, your 1099 workers will need to account for them individually once tax season approaches.

W2 Employee Taxes

If your employees are listed under a W2 employment status, they are referred to as employees within your organization. They have regular hours or salary and are therefore eligible for your company’s benefits. W2 employees also are taxed on each paycheck for federal and state taxes. Typically, this means there are little to no surprises on their tax returns come April 15th.

How to Determine if a Worker is W2 or 1099

Generally speaking, the amount of control you want to have over a worker will determine whether you fill out a W2 or 1099 form. That’s somewhat vague, but there is no quantitative test to determine the answer. Depending on your type of business, this could be a little or a lot.

The IRS looks at three categories to determine how much control or independence you have with a worker that include:

- Financial: Does your business control or have the right to control the business aspects? For example, the IRS considers whether expenses are reimbursed and supplies are provided.

- Behavioral: Does your business control or have the right to control the work and how the job is done?

- Relationship type: Is there a written contract? Do you provide employee-type benefits like vacation time or maternal leave?

Since there’s not a definitive way to determine if a worker is W2 vs 1099, it’s important to consider the whole relationship and how much you direct their activities. You must make sure to document these factors when determining whether an employee should be classified with a W2 or 1099.

1099 vs W2 Employee: Which is Right for Your Business?

So, back to the initial question: 1099 vs W2? Ultimately, whether to hire a contract worker or employee is up to you and the needs of your business. Whether you run a retail or eCommerce business, you may find that both types of workers might be necessary, depending on what your business needs. Ask yourself some of the questions below to help you decide which is right for your business:

- Is this worker vital to my business?

- If the worker left the company, could my business continue to meet ongoing demands?

- Do I feel comfortable managing the work of a remote worker?

- Do I trust that a contractor will be able to deliver quality work on time?

Deciding between 1099 vs W2 hires is an essential step for your small business financial planning. Use your answers to determine which employment type is right for your business. And if needed, incorporate the potential worker into the conversation, they may have a preference if you’re undecided.