Why Join The Best ISO Agent Program?

As we expand our technology, the process of onboarding, approval, and deployment gets better. Our clients and merchant service partners love it.

PaymentCloud offers all partners:

1. An onboarding demo & assistance with your first sale

2. Ongoing training with current payment trends

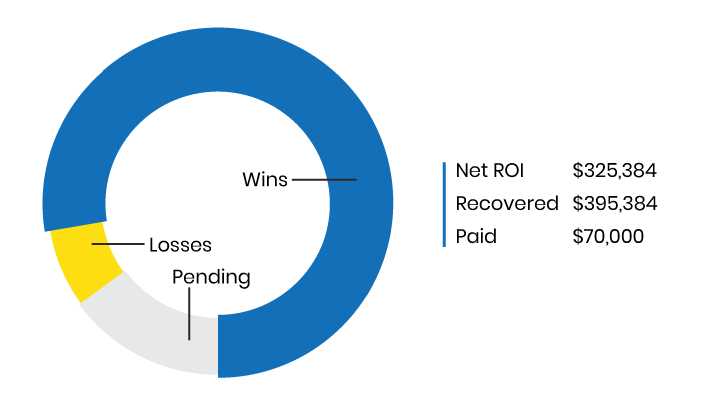

3. Portfolio management and lifetime residuals

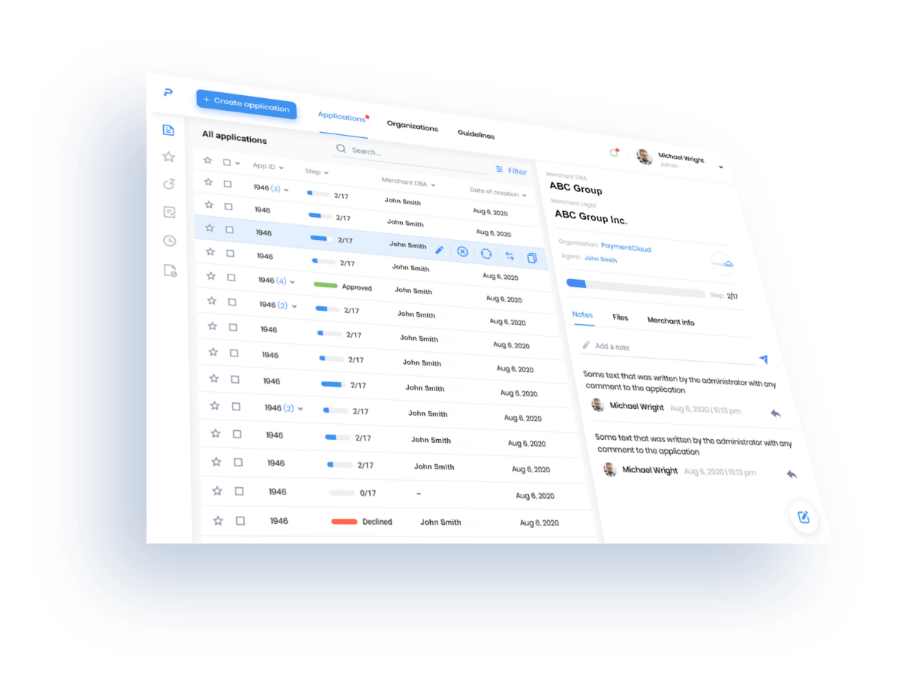

4. Cutting-edge equipment & full access to Stratus

Within seconds of you filling out the online pre approval application, we get to work on finding the best home at the best rates with the best solutions for your merchants. Let us take care of the leg work so you can continue building your sales funnel and raking in the residual income.

Play to discover the PaymentCloud Partner Program

Play to discover the PaymentCloud Partner Program