Payment Fraud Protection Services

Credit card fraud detection, protection, and prevention is important for all businesses, no matter their size.That’s why we’ve created the perfect combination of services to stop credit card fraud in its tracks.

- Automated capabilities

- Easy to use interface

- Reduced chargebacks & fraud rates

- Customizable options

- PCI compliant solutions

- Updated fraud detection practices

Detect, Prevent, and Protect against Fraud

A 2019 AFP Payments Fraud and Control Survey revealed that 82% of companies were targets of payment fraud in 2018. This is a staggering number of businesses who have been challenged with merchant account fraud, and only a fraction of them had proper mitigation techniques in place.

This is where PaymentCloud comes in.

We have a robust set of credit card, debit card, and ecommerce fraud prevention tools for merchants to detect credit card fraud and protect your merchant account from risk.

PCI Compliance

Preventing credit card fraud starts with PCI compliance. All businesses that accept electronic payments must comply with the Payment Card Industry Data Security Standard.

Automated Detection

Detecting common fraud techniques, such as friendly fraud, will equip you with increased processing power. Detect fraud automatically with integrated solutions.

Consumer Data Tracking

Every business comes across credit card fraud, but it’s important to know how it is happening and who is doing it. Tracking your consumer data will be an invaluable way to combat fraud.

Ready To Get Started?

Create an account instantly and be assured with our fraud prevention tools. You can also contact us to design a custom package for your business.

eCommerce Fraud Prevention

It’s easy to hide fraudulent transactions behind a digital screen which is why eCommerce merchants experience more risk. Adopt credit card fraud protection procedures into your merchant account to help keep fraud at bay.

Fraud Alerts

Whenever there is suspicious activity from a customer on your merchant account, fraud alerts will notify you so that you can catch it before it gets worse.

Temporary Payment Halt

Being able to briefly stop a payment from going through is an important tool for credit card fraud prevention. Validate or deny a halted transaction to keep your account safe.

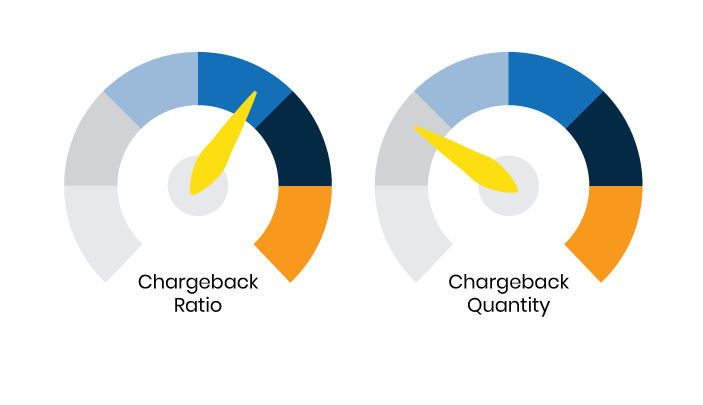

Credit Card Fraud Detection and Friendly Fraud

Friendly fraud makes for a large part of merchant credit card fraud and deserves extra attention. This type of fraud occurs when a customer disputes a legitimate charge for a product or service through their bank. The amount is then conditionally refunded to the customer while the issuer investigates.

There are some times in which the customer’s claim is valid: The item wasn’t delivered, the item was returned but no refund was processed, or their credit card was compromised. But unfortunately, this is not always the case. Customers can always make a claim with their bank even if they did receive the product and have no intention of returning it. This is when the transaction becomes friendly fraud (aka ‘chargeback’) and the customer is looking to get repaid for a product or service that they actually received.

In order to help prevent this type of merchant account fraud, business owners should talk to their payment processor as well as:

- Ensure you have shipping and tracking methods in place for every product that goes out. This way you have a better idea of when the order was received by a customer and in some cases even have photo proof that it made it to their doorstep.

- Clearly display your refund and return policy on your website. It should state the timeframe in which an item can be returned and when the refund should appear as well as have contact information available to the customer.

- Handle returns in the same way as purchases. Track the shipments so that the customer has no chance of claiming a return was made when, in fact, it wasn’t.

- Reach out to the customers to get their feedback on the delivery of the product or service. This may include a confirmation that they received the product or service, a confirmation that their card was charged correctly, and a way for you to communicate with the customers if anything pops up in the future.

Limit Merchant Account Fraud Risk

Making small adjustments to your business can make a huge impact. This is why simple things like displaying a foolproof refund and return policy and tracking the shipments you send and receive will reduce your risk of credit card fraud.

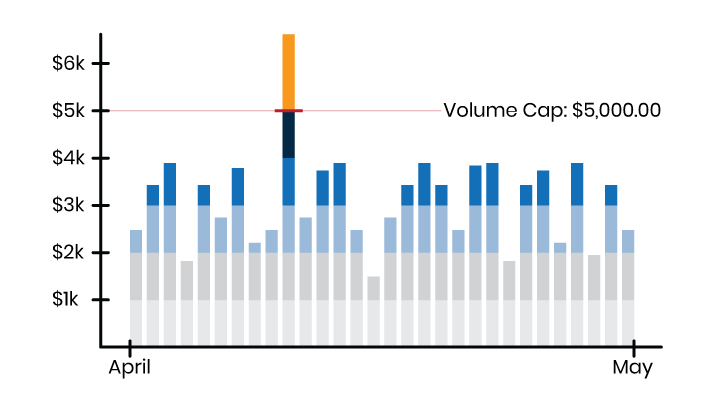

Filters and Thresholds

Merchant account fraud commonly takes the form of sudden, repeat transactions or higher than average ticket sizes. For this reason, it is important to keep track of these metrics when running your business. Set up volume and redundancy filters to cut out the noise and bolster your credit card fraud detection tactics.

Filters and Thresholds

Merchant account fraud commonly takes the form of sudden, repeat transactions or higher than average ticket sizes. For this reason, it is important to keep track of these metrics when running your business. Set up volume and redundancy filters to cut out the noise and bolster your credit card fraud detection tactics.

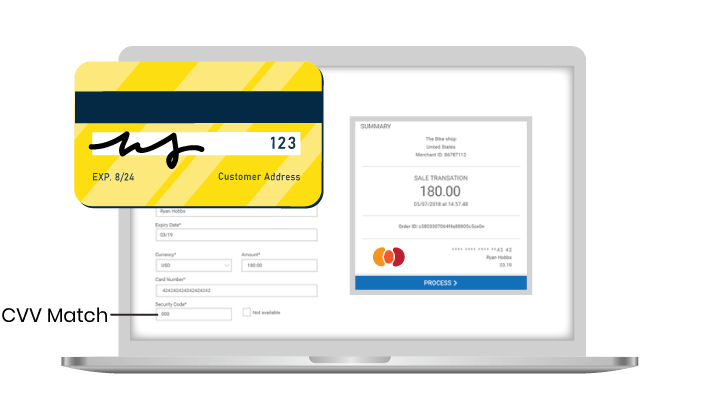

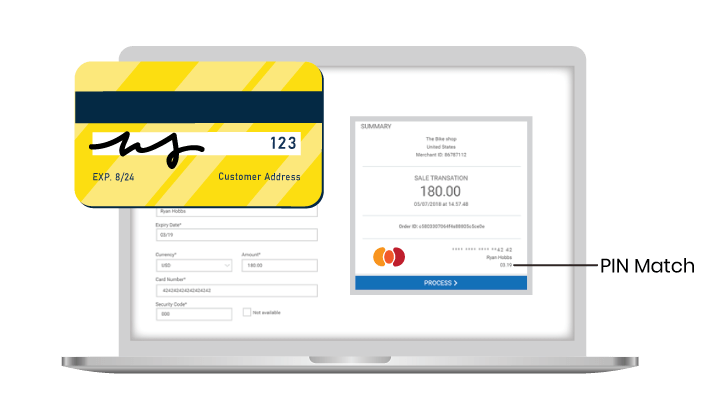

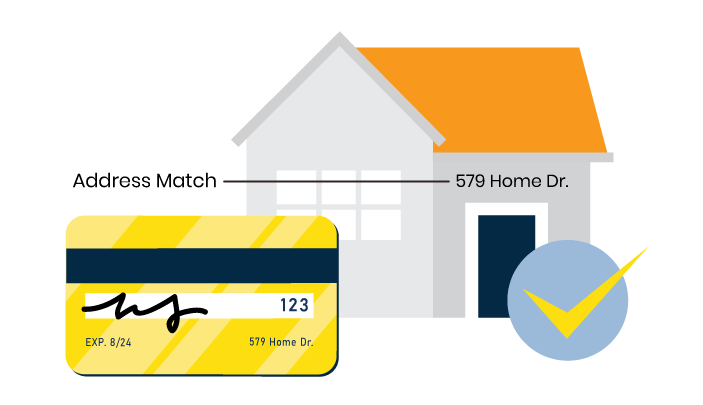

Address Verification System (AVS)

Validate cardholder information by using this system that matches the billing address on the card to the one provided in the purchase. It is a simple and effective tool in credit card fraud detection.

Payment Fraud and Your Merchant Account

It’s common that the merchant account’s supporting bank assumes the initial responsibility when credit card fraud occurs. As a result they often exercise fraud prevention measures such as maximum limits and high volume filters. And a freeze will be placed on the merchant account if the bank notices unusual account activity.

But after that initial responsibility is fulfilled, the supporting bank will look to you to recoup their losses. This may be by drawing from your merchant account reserve or putting more limits on your payment gateway.

Do what you can to mitigate risk factors for fraud on your merchant account by implementing the filters above, utilizing chargeback protection for friendly fraud, as well as working with your merchant account provider. PaymentCloud provides some of the best credit card fraud prevention for merchants on the market. They utilize tactics that help your account stay healthy and happy longer. Find out more about our process and what your business needs by starting the conversation about merchant account fraud.

Ready To Get Started?

Create an account instantly and be assured with our fraud prevention tools. You can also contact us to design a custom package for your business.

Fraud Protection by PaymentCloud

Setting your business up for success through the use of fraud mitigation tools is essential. At PaymentCloud, we believe you shouldn't have to choose between security and functionality when processing payments. Discover how easy it is to arm your business from credit card fraud today.

No Extra Hassle of a Separate Application

Each merchant account is evaluated for their specific risk factors. This way we know what tools you will need in order to detect and prevent credit card fraud.

Easy Integration with Your Merchant Account

Once you have identified the tools that you want, getting them onto your payment gateway or virtual terminal is a breeze.

Free to Use from PaymentCloud to You

We never charge you for the fraud prevention that you need. This is why our merchants love us and utilize our tools on their PaymentCloud merchant account.